In today’s cutthroat business world, do you know where your business stands among industry giants? Are you aware of the metrics that truly measure your financial health against your competitors?

Financial Benchmarking isn’t just about numbers—it’s about leveraging them to pinpoint growth opportunities and fine-tune your strategies for maximum efficiency and profitability.

Financial Benchmarking is the process of comparing business performance against industry standards. It encompasses thorough performance assessment, determining best practices, making provisions for realistic goals and risk management.

It also involves the measurement of financial performance and health relative to industry norms and competitors. Banking institutions can benchmark metrics such as return on assets, net interest margin, cost-to-income ratio— toward areas of improvement, optimise capital allocation, and drive overall financial resilience and competitiveness in view of the dynamic nature of regulations and economic environments.

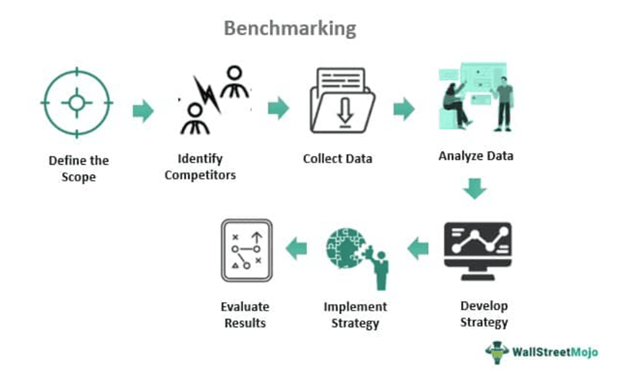

Source: Wall Street Mojo

Types of Financial Benchmarking

Internal Benchmarking

Internal benchmarking expedites eliminating the waste of both time and money and encourages organisations to designate their resources on the areas that need improvements. It empowers businesses to focus on benchmarks such as employee performance, productivity, resource allocation, products and services, etc.

Comparing the historical data reveals best practices and more efficient ways in the organisation.

Competitive Benchmarking

Competitive benchmarking plays a significant role in gauging the financial health of the business. Comparing the overall turnover or financial metrics of revenues, profit margins, and ROI with that of the competitors gives you a clear view of where you excel in and areas that have to be improved upon.

Strategic Benchmarking

Strategic Benchmarking is one of the most consequential for businesses. It takes one step forward from competitive benchmarking, where businesses compare specific performance metrics and strategic goals from those of their competitors. This enables them to set realistic goals and targets, and overcome challenges.

Rolls-Royce looks at what its rivals are doing and coming up with. This helps the company spot chances to improve its tech, cut costs, and grow in new markets. As a result, Rolls-Royce keeps growing and stays ahead of the game.

Learn more: Benchmarking Success: How Financial Data Can Help Your SME Compared to Industry Leaders

Financial Benchmarking Process Explained

Step 1: Identify Metrics and Benchmarks

Diagnosis of measurable financial metrics or KPIs regarding benchmarking, like competitor data, profitability ratio, liquidity ratio, debt ratios, or historical performances. This will arm businesses with SMART—specific, measurable, achievable, relevant, and time-bound—objectives to work toward.

Step 2: Gather Data for Analysis

Gather essential financial documents, such as income statements, cash flow statements, balance sheets, etc. Employing financial analysis tools and software, such as Pulse, that helps set SMART objectives for your business is also a wise choice.

Step 3: Identify Discrepancies and Opportunities

Compare relevant financial ratios and metrics, interpret the data and locate the areas of discrepancies and opportunities. Consider factors such as market conditions, operational efficiencies, cost structures, and strategic decisions for quantitative and qualitative analysis.

Step 4: Develop Realistic Strategies

Completing a comprehensive analysis of benchmarking insights and identifying areas of improvement, it all comes down to developing a more realistic approach or strategies to enhance financial performance.

These insights encourage informed decision making and lead businesses to success. This involves cost-cutting measures, revenue enhancement strategies, process improvements, or investment in new technologies.

Step 5: Implement, Evaluate and Review

Implement the strategies developed, regularly monitor financial performances against benchmarks and targets, and make necessary modifications based on monitoring results.

Case Study

#1. Risk Management in Banking Sector: JPMorgan Chase & Co.

Problem: Subtle fraudulent activities and possible credit risks could not be made out earlier with the traditional methods of risk management in view of the vast amount of data involved.

Solution: JPMorgan Chase & Co. implemented big data analytics and machine learning to analyse large datasets, identify patterns, and predict risks. They use AI technologies that improve accuracy over time, predictive analytics for forecasting risks, and simulation models for stress testing various market scenarios.

Outcome: These advancements enhanced the bank’s resilience, reduced operational costs, minimised fraud losses, and improved overall financial stability and health.

#2. Optimising Professional Services Operating Model: A SUMS Member University

Problem: The University needed to ensure high maturity levels in its operating model for professional services, demonstrating an optimal staffing structure and appropriate cost base in line with sector norms. This was critical due to the changing policy landscape and potential impacts on student recruitment despite current positive trends and a healthy operating surplus.

Solution: SUMS conducted a sophisticated benchmarking and diagnostic analysis of the professional services staffing cohort. They compared the University to regional competitors and sector best practices. Initial sessions with internal stakeholders assessed available data, and SUMS combined this with quantitative and qualitative intelligence to create a bespoke benchmarking model. Insights from this analysis were shared in workshops with the professional services leadership team and Vice-Chancellor’s group, leading to the exploration and agreement of target operating model design principles. Detailed recommendations were made for adopting best practices and reducing costs.

Outcome: SUMS recognised the urgency to redevelop the University’s professional services in a manner to deliver customer-focused services at reduced costs. These would involve the reconfiguration of areas that are over-established and need to be ‘retained faculty-based’. This led to the formation of the Vice-Chancellor’s Group, which agreed to the design principles that entailed the alignment of non-academic posts to Professional Services and refocusing the delivery on the customer’s convenience. This laid the ground for the further detailed development of the target operating model.

More case studies: 10 Financial Analytics Case Studies

Summary

Embracing benchmarking as a strategic imperative offers a pathway to sustainable growth and competitiveness. To leverage financial data and strategic insights, SMEs can use Pulse and set SMART objectives for their business, identify areas for improvement, capitalise on strengths, and navigate challenges effectively.

As this article highlights, financial Benchmarking equips businesses with crucial insights to refine operations, set realistic goals, and navigate competitive landscapes effectively. By leveraging internal, competitive, and strategic benchmarking, organisations can foster innovation, improve efficiency, and achieve sustained growth in an ever-evolving economic environment.