Upgrade your lending process with advanced analytics

Monitor borrower performance, assess risk, and make real-time credit decisions backed by our detailed financial insights and automation.

Our Partners

Accreditations

.svg)

Features

What Pulse offers

Master Your Receivables

DebtorIQ

Stay on top of late payments with real-time insights into risky customers, and smart follow-up actions. Built into Pulse, it sends custom alerts and offers a downloadable audit report for a clear, shareable view of your receivables.

Proactive risk management Stay ahead with alerts on late-paying customers and ensure healthy cash flow.

Financial management Keep track of payments and cash flow to maintain a strong credit rating.

Indirect credit improvements Pulse enables fiscal insights, encouraging you to monitor finances to increase your credit score.

STRENGTHEN CREDIT ASSESSMENTS WITH REAL-TIME CLIENT DATA

Refined credit assessment processes

Enhance your credit assessment process with our Open Accounting and Open Banking integrations. Pulse ensures accurate data-driven decision-making by offering deep insights into cash flow forecasts and SME financial data.

Automated Credit Assessments Real-time financial data streamlines the credit assessment process.

Loan Structuring Customise loans with precise cash flow analysis for better borrower alignment.

Faster Lending Decisions Approve loans quickly with reliable data analysis.

Portfolio Monitoring Track risks across all client portfolios in real- time.

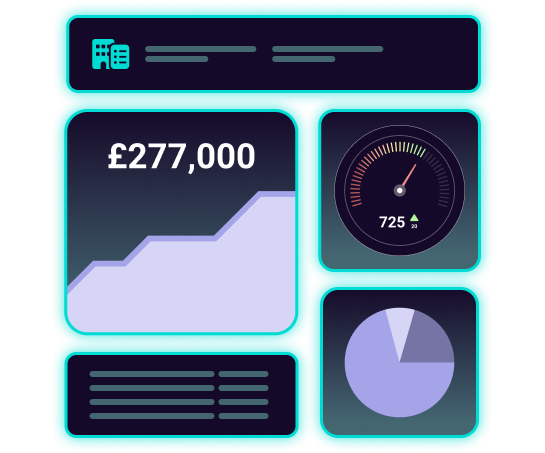

KEEP TRACK OF YOUR BUSINESS’S CREDIT HEALTH

Business credit score

Monitor cash flow, profitability, and payment behaviours to guide your clients toward better creditworthiness, reducing risk while securing improved loan terms.

Proactive credit risk management Address risks early with actionable insights.

Improved Loan Terms Boost clients’ credit profiles for favourable financing options.

Ongoing Monitoring Use real-time data to strengthen creditworthiness.

Strategic Advice Optimise client finances through consistent data analysis.

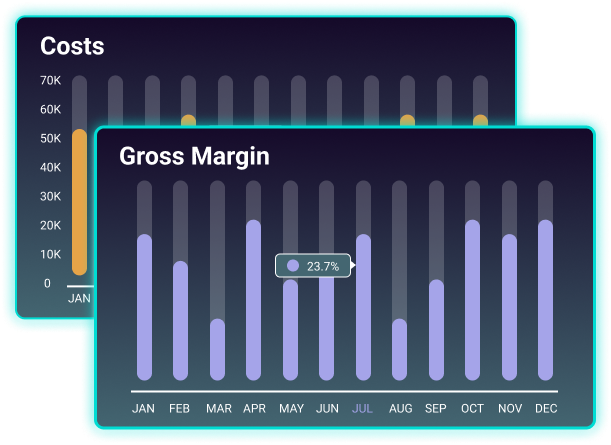

Your New Go-To for Smart SME Forecasting

aiPredict

aiPredict simplifies forecasting so you can deliver better insights faster. Help clients plan, grow, and make informed decisions with accurate, intuitive financial forecasts.

Client cash flow analysis Quickly review key metrics to spot trends and guide client decisions.

Cash flow forecasting made easy Deliver reliable projections that support tax planning and funding strategies.

Profit and loss forecasts Forecast revenue and costs to support smarter budgeting and advisory.

Balance sheet forecasting Track and project financial positions to support long-term business planning.

PROVIDE DATA-BACKED FINANCIAL GUIDANCE

Data-driven decision making

Pulse consolidates financial data analytics into actionable insights, enabling strategic planning and improved resource allocation for your clients.

Informed Resource Allocation Help clients optimise their finances using accounting data analysis.

Risk Management Mitigate losses with early detection through real-time financial insights.

Scenario Planning Use forecasting tools to simulate outcomes and support client scaling.

Strategic Growth Develop long-term plans rooted in reliable financial analysis.

Deliver Tailored Financial Solutions

Personalised client solutions

Gain detailed SMEs financial data insights, enabling you to offer bespoke financial solutions, from loan optimisation to strategic financial planning.

Tailored Advice Deliver recommendations aligned with client goals using real-time financial insights.

Customisable Loan Structures Adjust terms based on detailed cash flow forecasts.

Proactive Engagement Anticipate client needs with data-driven guidance.

Strengthened Relationships Build loyalty with solutions that grow alongside your clients.

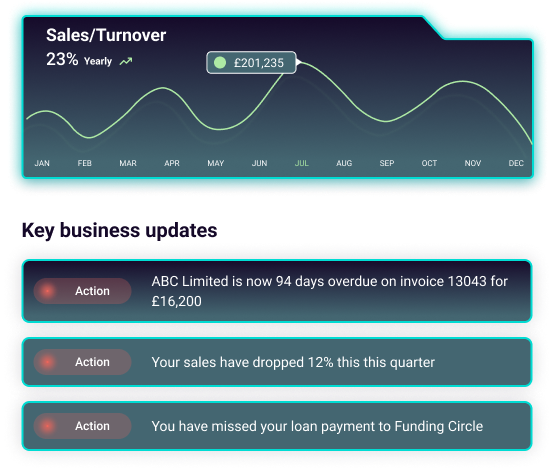

SHEILD CLIENTS FROM RISKS WITH REAL-TIME ALERTS.

Fraud detection and prevention

Pulse offers a robust risk assessment platform, delivering real-time alerts for potential risks like declining cash flow or missed payments. Empowering you to protect your clients’ interests.

Real-Time Risk Alerts Get instant notifications about cash flow issues, aiding quick interventions.

Proactive Risk Management Leverage actionable insights for effective credit risk monitoring.

Continuous Monitoring Track client KPIs to address financial challenges promptly.

Liability Insights Identify risks like debt accumulation through detailed cash flow analysis.

OFFER CLIENTS WITH MINUTE FINANCIAL DATA

Real-Time financial insights

Leverage real-time financial insights to stay updated on your clients’ financial health with Pulse. Gain instant access to consolidated data, enable proactive decision-making and accurate guidance based on SMEs financial insights.

24/7 Access to Real-Time Client Data: Monitor client performance via web-based portal that delivers real-time data for seamless accounting data analysis.

Proactive Guidance Detect trends and provide solutions early, ensuring clients make informed choices.

Scenario Analysis Run predictive financial modelling to simulate market changes or inefficiencies.

Trend Identification: Spot patterns with real-time data analytics to support long-term business growth.

Industry Benchmarking

Pulse GPT

PROCESS

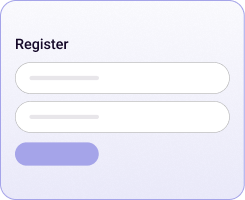

How it works

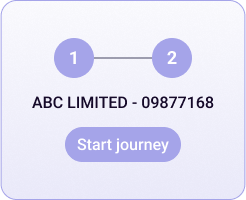

From signing up to linking your financial data, getting started with Pulse is quick and easy. Just follow the three simple steps below to begin!

Join Pulse using our quick and easy registration process

Invite your clients and get your portfolio set up in a few clicks

Guide your clients to seamlessly connect their bank accounts and accounting software

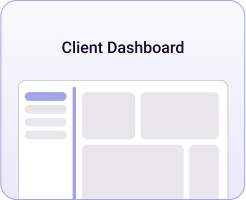

Access your complete client portfolio and see real-time updates from the moment you log in

View business goals set by your clients and track their progress to provide expert guidance

Protection

Safe and secure, as it should be

Built on trusted protocols and certified by Cyber Essentials Plus, we make it our priority to deliver class-leading security.

Leveraging the power of Microsoft Azure, Pulse ensures your data is managed on a secure, reliable, and scalable platform. We protect your financial information with comprehensive encryption, both at rest and in transit, and employ stringent security measures such as multi-factor authentication, geo-fencing, and IP restrictions to block unauthorised access.

Explore Now

Remember

Every device and user in the Pulse network benefits from enhanced protection through Microsoft Entra ID, guaranteeing the security of your digital identity at all turns.

PARTNER ECOSYSTEM

Who we work with

At the heart of Pulse, we work with some of the market-leading technology and service providers to deliver the best product capabilities and solutions for SMEs. Whether you're looking to streamline operations, enhance your marketing strategies, or explore new financial technologies, our marketplace is your gateway to a world of expertise.

Explore NowBe a part of our Partner Ecosystem

Join ustestimonials

Why work with us?

RESOURCES

Empowering your journey

Crafting Financial Models That Make Venture Capitalists Take Notice

The success of a startup often depends on its ability to secure funding, with the...

READ MORE

Choosing the Right Business Forecasting Tools in 2024

How often do you sit down at your desk, take a look at your emails,...

READ MOREFAQs

Unlock financial insights today

Get access to real-time business insights and analytics