“The future of accounting lies in leveraging technology to deliver real-time financial insights, enabling businesses to make more informed and agile decisions.” – Sue Almond, Global Head of Assurance at Grant Thornton International Ltd

With automation now more accessible, the accounting industry is right at the frontier in leading an automatic revolution. Based on a report by McKinsey, it has now become easier to implement automation compared to previously; there is a host of AI solutions that assist accountants. As such, this has allowed for the automation of 30%—35% of accounting activities, leading to a time – and resource – efficient way of managing finances.

Overview of Accounting Tools

Accounting software is used to record every transaction taking place in an organisation. The accounting software tool allows bookkeepers and accountants to record transactions and analyse large amounts of information from many departments. With software in place, creating various financial documents and reports becomes easier.

Systematic recording of the financial documents helps produce the reports on a monthly, quarterly, and annual basis; these would also include P&L statements, cash flow statements, balance sheets, and the statement of stockholders’ equity. It makes the performance of various departments visible.

In trying to keep data accurate, accounting software helps locate trends and analyse business growth and other critical measurements for making sound decisions. Besides improving the bookkeeping system’s efficiency, the software enhances data efficiency by preventing repetitive errors and automating tedious tasks.

Types of Accounting Tools

Cloud-Based Accounting Software

Cloud computing software benefits include flexibility in accessing and processing client’s data regardless of time and location. It is an advanced solution that facilitates quick solutions to problems.

Utilised to their full potential, the cloud-based tools can naturally enhance client relationships manifold. Firms need to catch up on modern accounting software solutions such as Pulse to gain a competitive advantage.

Commercial Off-The-Shelf (COTS) Software

This improves user control, increases the many levels of error detection to prevent entering erroneous data, and automatically generates standard reports that can normally be configured to meet user needs. Some COTS packages were designed to be industry-specific and installed with additional features catering to the target industries’ needs.

Enterprise Resource Planning (ERP) Systems

ERP software amalgamates data from various parts of the business into one database. This method rectifies all the problems created by independent, department-specific software that doesn’t share information. However, it is excruciatingly expensive and may take more than a year to install, making it more suitable for big and complex organisations.

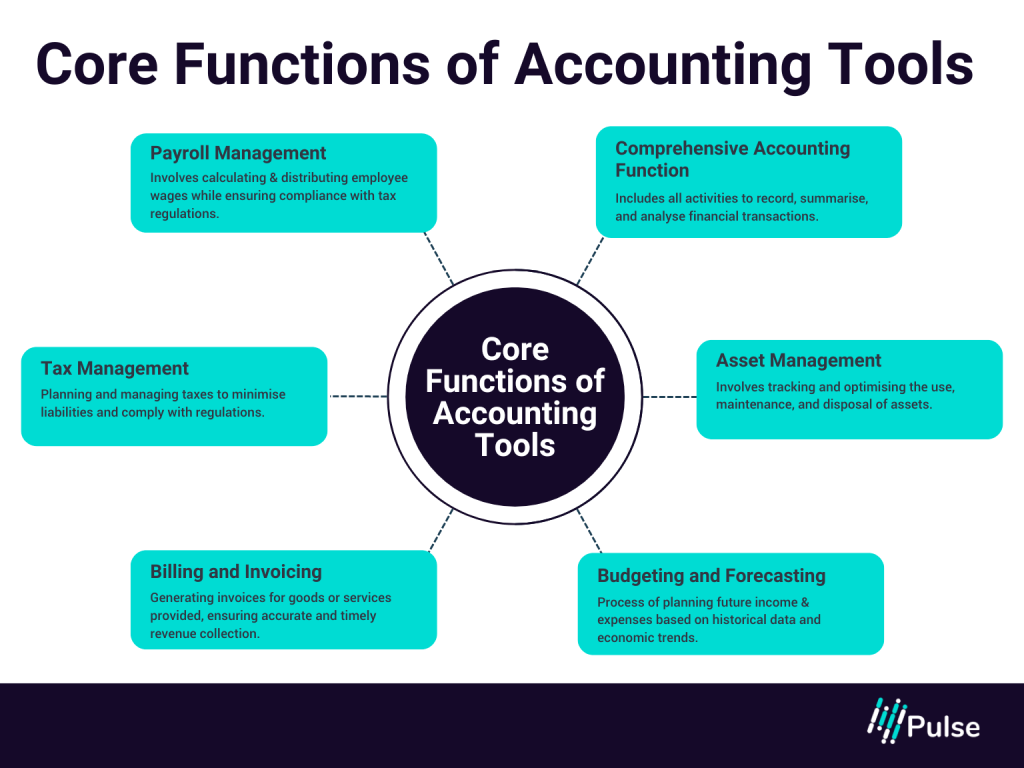

Core Functions of Accounting Tools

It is necessary to choose the right software according to the requirements. Some common features with which every accounting software may consist are double-entry accounting, accounts receivable and payable, banking, and the feature of reporting.

Here are some additional features that can be tailored to meet specific needs and software types.

Comprehensive Accounting Function

Any accounting software naturally takes care of recording transactions, ledger management, preparing financial statements, and several other important accounting functionalities. It also follows rules and regulations, provides audit trails, and integrates with other business systems to function. These reconcile accounts accurately, supporting informed decisions and allowing businesses to manage their finances.

Asset Management

Tracking and controlling the lifespan of data of both short-term assets like inventory and long-term assets like machinery and real estate can be challenging. Employing asset management software enables automated depreciation calculations, often allowing the application of different depreciation methods to meet both GAAP compliance and tax requirements.

Budgeting and Forecasting

Accounting software usually offers budgeting and forecasting as their mainline package feature. This feature allows businesses to analyse a combination of past and real-time data, forecast budgets and project future performance. It also guides businesses to set more realistic targets and goals.

Payrolls Management

Advanced accounting systems contain payroll modules that provide integrated services to determine wages, process payrolls, and account for them while maintaining associated taxes and deductions payable.

Some essential characteristics include variable pay rates with different frequencies—monthly, quarterly, yearly, and so on—and types of compensation for benefits such as health insurance and retirement plans. Some software can also automatically read and analyse timesheets to cut checks or directly deposit funds into employees’ bank accounts.

Tax Management

This feature simplifies the tax compliance process by automatically running complex local, national, and global tax calculations. With this, businesses can be much more confident that they are paying and collecting the appropriate taxes wherever the business is concerned and can provide line-item detail records when required.

Billing and Invoicing

Accounting software enhances cash flow by automating the invoicing and collections process by promptly generating invoices for accounts receivables, managing credit terms, and improving collection through automatic alerts and options for multiple payments.

It will scan bills coming in, encode expenses, automatically track approver workflows, schedule payments, and manage disbursements in accounts payable. This prevents any delays in payments and manages disbursements.

How to Choose Accounting Software

- Understand Unique Business Needs: Identify and understand specific business requirements such as hybrid or cloud accounting software integration, budget constraints, employee skill compatibility, add-on features, customisation, and automation needs.

- Consider Desired Features: Determine desired features that are tailored to your requirements, like payroll, invoicing, budgeting, sales, tax preparation and filing, and transaction tracking to decide between computerised or manual systems and to select specific software.

- Automation Capabilities: Another essential consideration should be whether the software offers automation for several recurring tasks such as invoice generation, data backups, payment reminders, etc. This automation can save a lot of time and prevent errors.

- Evaluate Resources: Assess available resources, including employee accounting skills and the company’s budget, to find a system that fits the existing capabilities and support structure.

- Compare System Parameters: Compare the benefits and components of different accounting systems to see which best meets the organisation’s needs, such as customisation options, software cost, scalability, security and compliance.

- Consult with an Accountant: Get help from a skilled accountant to pick a system that fits their abilities and what the business needs. If you don’t have an accountant, go for a system that works well with your staff’s skills and how they like to work.

How Pulse Helps Automate Accounting Process

| Capability | Description |

| Cloud-Based Solutions | Offers flexibility for accessing and processing client data regardless of time and place, enhancing collaboration and efficiency. |

| Workplace Efficiency Tools | Integrates tools for time and project management, delegation, automation, and organisation to streamline workflows and reduce stress. |

| Financial Analysis Tools | Offers financial aggregation and analysis capabilities, including cash flow analysis and forecasting using AI and ML. |

| Data Visualisation Tools | Translating complex financial data into intuitive infographics makes it easier for clients to understand their financial health. |

| Open Banking Integration | Allows access to client’s financial data via secure banking APIs, facilitating comprehensive financial management. |

| Open Accounting Integration | Provides transparency of business transactions, enabling informed strategic decisions and improved client relationships. |

| Automation and AI Tools | Automates repetitive tasks and offers predictive insights and advanced data analysis to assist in risk assessment and decision-making. |

| Real-Time Insights | Delivers real-time financial data and insights, allowing accountants to provide up-to-date, strategic advice to clients. |

Pulse leverages modern fintech tools to enhance accounting practices, offering a comprehensive suite of features to improve efficiency, data presentation, and client relationships.

Join leading businesses that are transforming their financial operations with Pulse. Sign up now and take the next step towards efficiency, security, and growth.