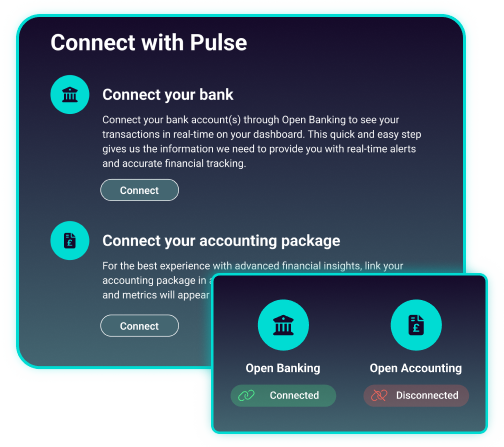

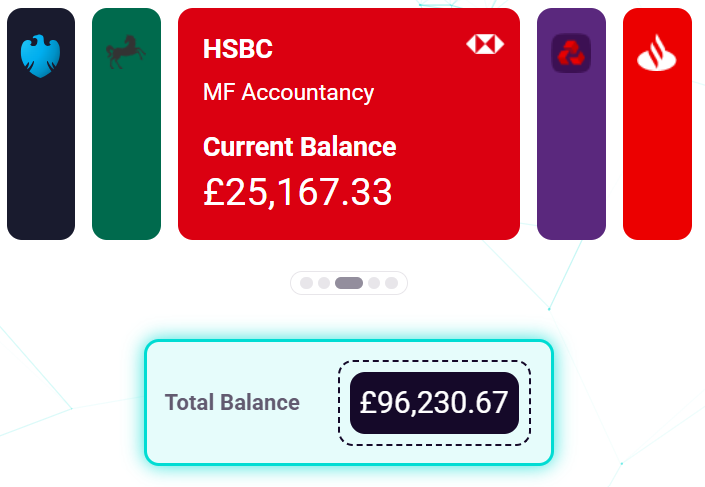

Integrations

We connect you to your clients

Imagine giving your clients 24/7 access to a web-based portal that reveals the impact of every financial decision.

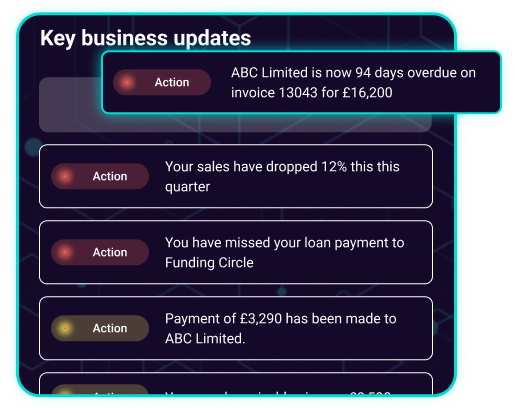

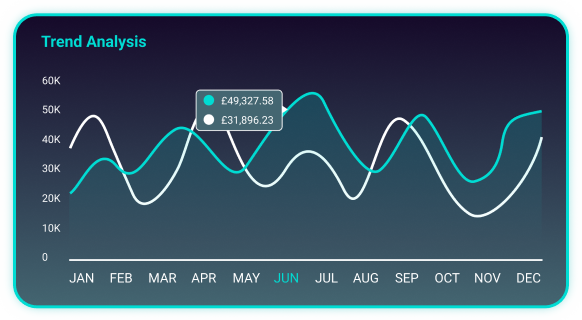

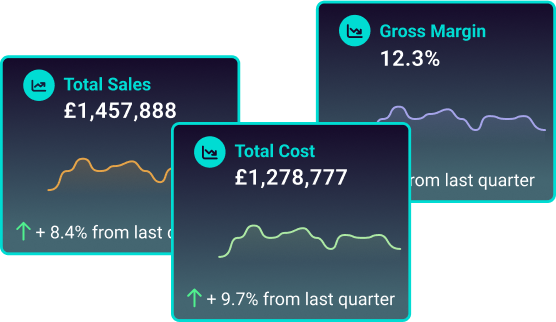

Pulse offers quick access to key business financial data, transforming it into actionable insights.

See all integrations30,000+

Open Banking Connections

4,000+

Open Accounting Connections

5,000+

Users

.svg)