Maintaining financial stability and making wise strategic decisions requires an understanding of how money moves throughout a company. When navigating through market rivalry, regulatory changes, and economic uncertainty, a solid cash flow analysis offers a dynamic perspective of operational and financial health in addition to a picture of liquidity. The guide offers a step-by-step approach to conducting a data-driven cash flow analysis using real financial statements and metrics.

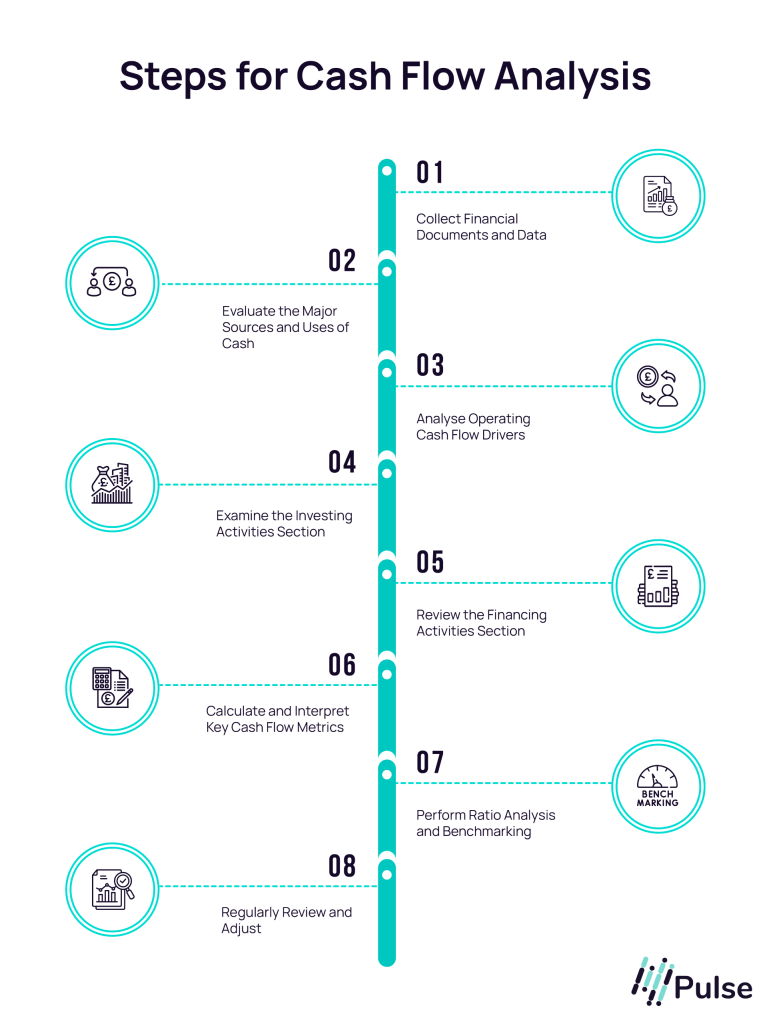

Step 1: Collect Financial Documents and Data

Collate all relevant financial documents: the Cash Flow Statement, Profit & Loss Account, and Balance Sheet. These reports provide the basis for the whole study. Accuracy is essential; material that is out-of-date or erroneous can seriously cloud your judgement and eventually result in bad choices.

If your organisation uses accounting software like Xero or QuickBooks, print out the statements for the time in question. Whether you are evaluating monthly, quarterly, or yearly papers, make sure that the accounting period is consistent throughout. This alignment ensures comparability and meaningful trend analysis.

Step 2: Evaluate the Major Sources and Uses of Cash

The Cash Flow Statement is structured into three principal sections: operating, investing, and financing activities. Analysing these components helps determine where your cash originates and where it’s being deployed.

For startups or small firms, the revenue comes from financing activities such as seed funding, grants, or early-stage borrowing. Many SMEs in their infancy rely on these external injections to cover setup costs, marketing, staffing, and product development. That said, this should be viewed as a temporary runway. The strategic aim should always be to pivot towards operating cash flow as the dominant inflow source over time.

Persistent negative cash flow from operations should raise a red flag. It indicates an over-dependence on external funding sources, which could become scarce or costly if the business fails to stabilise its core operations. Over time, operational self-sufficiency must become the financial anchor.

In contrast, for well-established organisations, the majority of cash inflow should ideally stem from operating activities. This signals a strong underlying business model capable of generating sufficient funds through day-to-day operations.

Step 3: Analyse Operating Cash Flow Drivers

Operating cash flow provides the purest reflection of how efficiently your enterprise converts its core activities into real cash. Begin by examining the inflows from customer payments and outflows related to suppliers, payroll, and other operational costs.

Next, analyse changes in working capital components such as trade receivables, stock levels, and accounts payable. Increases in receivables or stock may restrict cash flow, whereas delays in paying suppliers can temporarily bolster it.

Importantly, compare operating cash flow with net income. A healthy business usually has more operating cash than net income reported because of non-cash charges such as depreciation or amortisation. If the reverse is true, high net income but weak cash flow, it could indicate collection inefficiencies, overstocking, or weakly negotiated payment terms. These are working risks that can be fixed, but only after they are detected.

Step 4: Examine the Investing Activities Section

Investing activities indicate how the company is investing cash in its future. This comprises acquisitions, purchases of tangible assets, or divestments.

Capital expenditure, like property, plant, or technology investments, typically is a commitment to future productivity or growth. Although cash outlays can be substantial, they should be consistent with your strategic objectives and growth projections. Disposing of under-utilised assets, on the other hand, can offer liquidity in times of need.

Startups and growing companies often show negative cash flow, which is justified if underpinned by long-term planning and revenue alignment. However, such activity must be deliberate and not simply reactive.

Step 5: Review the Financing Activities Section

This section captures the financial mechanisms keeping your business capitalised. Review earnings from shareholder equity or funding rounds. Then, consider cash outflows for loan repayments, lease obligations, or dividend distributions.

It is essential to understand the sustainability of these movements. Are you repeatedly borrowing to fund operations? If so, when are repayments due, and their impact on your monthly cash availability

Healthy financing activities should reflect balance. Excessive reliance on debt can burden a company with unsustainable interest obligations. Equally, underutilising available capital could stunt growth potential at a critical juncture.

Step 6: Calculate and Interpret Key Cash Flow Metrics

Now that the groundwork is laid, the focus turns to measuring cash performance through financial key KPIs. These metrics enable monitoring of the performance over time, peer comparison, and the identification of strategic opportunities or financial distress.

Net Cash Flow presents a clear view of a business generating or burning cash over a given period. Positive net cash flow indicates growth potential and room for investment. Negative figures may be tolerable during planned expansion phases, but persistent deficits warrant deeper scrutiny.

Operating Cash Flow (OCF) offers an unbiased measurement of operating liquidity. Healthy OCF indicates healthy profit conversion to cash, an important consideration for sustainability.

Free Cash Flow (FCF) subtracts capital expenditures from OCF, illustrating the availability of cash for distribution, reinvestment, or debt reduction. SMEs with consistently positive FCF are better positioned to weather economic shocks or seize growth opportunities.

Unlevered Free Cash Flow (UFCF) takes this one step further by eliminating the cost of capital, giving us a perspective on cash available to everyone involved before the servicing of debt. It is especially valuable in business valuation and strategic planning scenarios.

Cash Flow to Net Income Ratio assesses how effectively reported profit converts to cash. A ratio close to 1:1 is ideal. A lower ratio suggests that earnings may not be backed by actual cash, a possible red flag for investors or lenders.

Current Liability Coverage Ratio quantifies the company’s ability to meet short-term obligations using operating cash. A high ratio signals solid liquidity and short-term resilience.

Price to Cash Flow Ratio (P/CF) is more relevant for listed companies but can inform SME valuations too. It is useful for capital-intensive businesses, as it highlights how investors perceive the company’s ability to generate cash relative to its price.

After computation, these metrics offer a quantitative method for evaluating financial performance, competitive advantage, and strategy coherence.

Step 7: Perform Ratio Analysis and Benchmarking

The next step is to contextualise them through comparison; both internally across historical periods and externally against industry benchmarks. This benchmarking process highlights trends, seasonality, anomalies, or financial red flags.

For example, a declining OCF-to-net income ratio over three quarters may highlight the deteriorating collection practices or rising operational costs. Benchmarking also uncovers strategic insights, such as where your cash conversion cycle lags behind peers, or if your capital investments are yielding competitive returns.

Remember, ratios are not static; they evolve with strategy, market forces, and operational shifts. Use them as a living dashboard, not a once-a-year formality.

Step 8: Regularly Review and Adjust

Cash flow management is not a one-time exercise. It must be integrated into your ongoing financial strategy. Monthly or quarterly reviews of cash flow statements and forecasts enable agile responses to emerging challenges or opportunities. SMEs must not only react to current cash positions but also forecast future movements to avoid shortfalls.

A Smart Way to Cash Flow Analysis and Forecast

Cash flow analysis doesn’t always have to be complex. With Pulse, SMEs can cut through the noise and get straight to the insights that matter. This financial data intelligence platform is designed to help small and medium-sized enterprises make faster and better data-driven decisions, without spreadsheets and manual work.

How Pulse Helps SMEs in Cash Flow Analysis:

- Real-Time Financial Data: Pulse simplifies data analysis by seamlessly connecting with your accounting software (like Xero or QuickBooks) and banking data through Open Accounting and Open Banking, pulling all your numbers into one dashboard. This means no more waiting for month-end reports.

- Visual Forecasting: This platform automatically tracks inflows, outflows, and trends over time, helping you spot issues early and plan. Whether you’re managing late payments or prepping for seasonal dips, it gives you a heads-up, not a headache.

- Scenario Planning: Expanding, taking a loan, or holding off on a big purchase; run what-if scenarios and see the impact on your cash position instantly.

- Clarity for Strategic Action: From tightening operations to strengthening loan applications, Pulse equips businesses with accurate, actionable insights to guide strategy and negotiations.

Final Thoughts

Cash flow analysis is more than just a compliance step; it is a strategic must for SMEs looking to scale in a sustainable manner. By utilising the complete framework, business leaders can make well-informed decisions, identify risks and act on opportunities with confidence.

Turn numbers into strategy. Book your demo at info@mypulse.io now.