According to 6Wresearch, the UK Accounting Software market is likely to grow during 2022-28. This growth is driven by the increasing demand from small and medium-sized businesses (SMBs) and multinational corporations (MNCs) for robust and affordable accounting solutions.

Getting back on this piece for our fellow number crunchers and financial wizards! Are you an accountant looking to streamline your processes and improve efficiency? Whether you’re a seasoned pro or just starting in the business, the right software can make all the difference regardless of your experience level in the industry. Accounting software today is an imperative tool for any astute accountant. Picture your software as the ultimate wingman, working tirelessly to increase your productivity and accuracy. After all, who wants to struggle with spreadsheets when technology can do the heavy lifting? Today, we will guide you through the world of accounting software.

Why Does Software Matter?

The evolutions and advantages of accounting software have changed the experience efficiently and have entirely transformed the technology; we have modified through the era from manual spreadsheets to accounting software tools, juggling from immense paperwork management and keeping tabs using software to gather information from the past accounting year in just one click has revolutionised the strength of reporting capabilities, reduced human errors and influenced multitasking responsibilities.

Why does the choice of the right accounting software matter? Imagine if you are building a skyscraper, and the material you use is plastic rather than concrete. Will it survive through the season and manage the wear and tear of its use? Indeed, not. The best option for accounting software is some top-notch brands available in the market that support your specific needs and requirements as per your workload and demands. Accounting software streamlines repetitive operations and lowers error rates, freeing up more time for you to concentrate on developing your company’s strategy and providing customers with excellent service.

Types of Accounting Software:

The right accounting software can streamline financial processes, providing valuable insights and accurate calculations, eliminating human error. In this article, we have explored and gathered some information to guide you through your journey to make the right decision for your accounting future.

Now, on to the juicy stuff. You must be thinking, what is safe integrated accounting software? Can I trust the tools with my sensitive data? Is this software reliable enough to manage my workload? So, when it comes to the right choice, capabilities, trust, and safe integration, we have resolved this issue with our study on this concern and combined the list for your requirements.

Cloud-Based vs. Desktop: Are you a desktop person, or do you prefer the freedom to work from any location? Where desktop software keeps things local and comfortable on your computer, Cloud-based Software is the right option that gives you the freedom to access your accounts from any device with an internet connection. With safe, integrated data backup, you can leverage this flexibility and skilfully control your work.

Small Business vs. Enterprise: All businesses, whether small or big, require the same expertise and competency when it comes to work. Whether it be a one-person operation or a division of a large corporation, it is a staple to satisfy your client with prompt services.

Specialised vs. All-in-One: Some accounting software like QuickBooks online or SAGE intacct are designed to handle comprehensive tasks that range from invoicing, tax preparation to generation financial report. At the same time, Free agent or Freelancer provide simplified self-assessment tax filing to tracking or project management which are tailored for SMEs.

Budget Considerations: Upfront costs, subscription models, and potential additional fees (e.g., for extra users, advanced features) Click here to learn more about price plans and benefits.

User-Friendliness and Training Needs: Evaluate ease of use, availability of training resources, and support options.

Features That Matter

Easy to use: Nobody wants to spend hours decoding and hieroglyphics to manually input data. You seek software that is easy to use and intuitive, quickly adapts to your responsibility, and fulfils tasks.

Automation: Bookkeeping automation for businesses requires accounting Software that saves tons of your time with an automated bank feed, tracks your expenses, and creates invoices, saving oodles of your time.

Reporting: Software should be capable of delivering reports more quickly than you can say “balance sheet”? If you use effective reporting tools, you can appear to your boss or clients like a financial wizard; the level of efficiency and multitasking responsibility that you get from software can free you up from simple tasks to manage more responsible workloads that need to be fulfilled.

Integration: Compatibility with other software, such as CRM software or payment processors, is vital. Seamless integration means less headache; easy integration gives you the flexibility to read data into software and manage it on any required device.

Top Picks (Drumroll, please!)

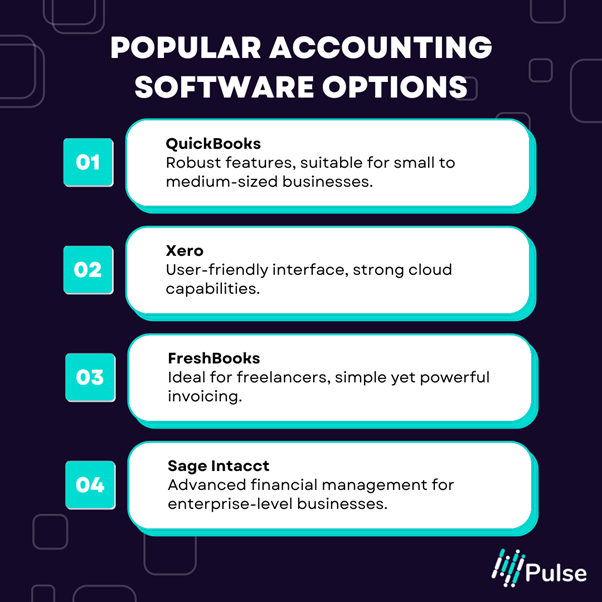

So, what are the hottest contenders in the accounting software showdown? Here’s a quick roundup of some favourites:

Final Thoughts: When choosing accounting software, it’s important to find the right fit for your style, budget, and workflow. It’s like finding the perfect pair of shoes. You can take your time to test drive a few different software programs (most offer free trials) and ask fellow accountants for their opinions. Whether you choose an all-in-one powerhouse or a specialised tool, the goal is to give accountants the resources they need to succeed in business, so they can focus on strategic initiatives, client service, and business growth. Utilising the capabilities of contemporary accounting software will ensure that financial operations are in competent hands.

Accounting is evolving; are you prepared to use Pulse to embrace the future? Sign up to Pulse and find out how this innovative tool can improve your company’s financial operations and efficiency.