Let’s discuss some accounting that can transform your journey through the Pulse portal. Have you ever struggled with the hectic task of feeding manual data and calculating? Many businesses need help with expense tracking, generating meaningful reports, and integrating various systems effectively, leading to inefficiencies and wasted resources. Accounting software has significantly boosted efficiency in the UK, especially with the adoption of cloud-based software by nearly 95% of accountants, which led to a 75% increase in profit. AI Integration has added £2 billion to the UK GDP and created around 20,000 jobs. As a result, significant growth of 72% has been achieved in 2023, tripling the revenue and job opportunities in the UK.

Pulse tackles these challenges head-on by streamlining expense management through banking statements and providing tailored reports for advanced data analysis, facilitating seamless integrations with other business tools. It serves as a comprehensive solution to optimise financial processes and improve operational efficiency.

This guide explores how Pulse enhances efficiency in business operations through streamlined expense management, customisable reporting, and seamless integrations. It highlights the software’s capabilities in simplifying financial tasks, improving data visibility, and improving your financial health. Let’s dive into a crucial topic that separates the rookies from the pros in the business game. And who better to learn from than Pulse, the champions of financial foresight and fiscal finesse!

Understanding the Pulse Approach

Effective financial management is crucial for businesses of all sizes. Traditional expense management and reporting methods often involve manual processes prone to errors and delays. Integrating disparate systems further complicates operations, hindering overall productivity. Pulse distinguishes itself with a comprehensive approach to cash flow management that combines dynamic technology with deep industry insights.

User-Friendly Dashboard: Pulse smoothly guides you through the features step by step, from Open Accounting and Banking to creating predictive analysis and cash flow statements to managing fund inflows and outflows.

Precise Forecasting: Pulse provides advanced predictive analysis that forecasts future trends. Unmatched accuracy in cash flow ensures financial ebbs and capabilities to enable businesses to empower proactive decision-making.

Real-Time Visibility: Our intuitive dashboard provides real-time analysis visible in financial transactions, including the inflow and outflow of cash and liquidity position. Such transparency enhances control and fosters agility in responding to market dynamics.

Time-Saving Automation: Say goodbye to tedious tasks. When Pulse automates configuration and expense tracking, you can focus on your other tasks without worrying about data management and repayment schedules.

Learn more about bookkeeping automation in a guide for business and accountants.

Customised Solution: Recognising unique needs and preferences helps us understand the industry’s client requirements. Pulse is implemented through tailored solutions, whether optimising payment schedules or identifying opportunities for working capital improvements. We made it efficient to optimise cash flow management through analytics and data integration.

Benefits of Using Pulse

Time is Money: Pulse saves you a massive amount of time with an API solution that allows you to avoid manually feeding data into the system. You can easily link your bank account and gather insight on cash flow statements.

Streamline Bookkeeping: Automation frees you from manual data entry and repetitive tasks and allows you to put effort into crucial tasks and strategic decision-making.

Industry Leading Innovation: Pulse continuously pushes the boundaries of cash management through dynamic management, harnessing AI-driven algorithms and machine learning capabilities to refine its adapting responsibilities and predictive models for evolving marketing solutions. This progressive approach mitigates risk and identifies growth opportunities that might go unnoticed.

Thought Leadership and Insight: Beyond technology, Pulse fosters leadership by sharing expert insight that gives you the advantage of analysing and meeting standard requirements. Pulse also shares best practices and optimised cash flow strategies that empower you to achieve your goals.

Looking Ahead: As businesses navigate an increasingly complex financial landscape, Pulse is dedicated to breaking new ground in cash flow management as companies negotiate financial environments, anticipate market trends and utilise cutting-edge technology. Pulse equips companies to endure but flourish during uncertain times.

Features That Will Blow Your Mind

Let’s discuss some features that you can unleash on the Pulse platform:

Manage expenses effortlessly with Pulse, acting as your tireless personal assistant. Create customised reports that genuinely resonate. Impress your stakeholders with visually stunning presentations and insightful data that speak volumes. Pulse integrates seamlessly with a plethora of platforms. Whether it’s your bank or accounting software, Pulse ensures your entire operation runs smoothly.

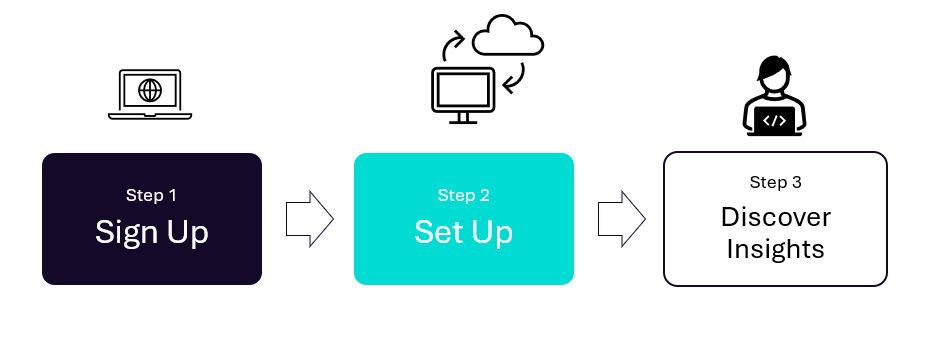

Ready to Join Pulse? Here’s How You Can Dive Right In:

- Sign Up: Head to our website and sign up for a trial.

- Set Up: Follow the simple setup wizard. It’s so easy; you’ll be up and running in minutes.

- Discover Insights: Browse around, explore the features and let Pulse work its magic. Remember, it’s all about making your life easier.

In conclusion, Pulse is a beacon of innovation and reliability in cash flow management. Through its integrated approach, Pulse equips businesses with the tools and insights needed to optimise liquidity, mitigate risks, and seize growth opportunities. As industries evolve, Pulse continues to lead the charge, setting the standard for excellence in cash flow management.

The Pulse Promise

We are essential software and a potent tool for managing your account. It’s about unlocking efficiency, saving time, and boosting your business—all with efficiency. So, what are you waiting for? Sign up for Pulse and take control of your finances today.