Empower your clients with data driven advice

Improve client relationships, identify opportunities for them, and create tailored financial strategies through our intuitive real-time platform.

Our Partners

Awards Recognition

What Pulse offers

PROVIDE YOUR CLIENTS WITH UP-TO-THE-MINUTE FINANCIAL GUIDANCE.

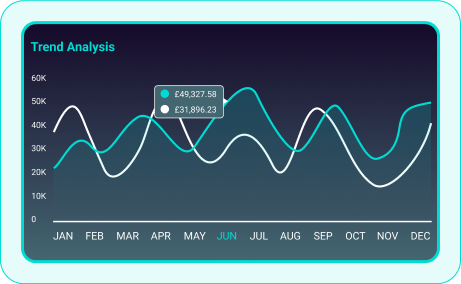

Real-time financial insights

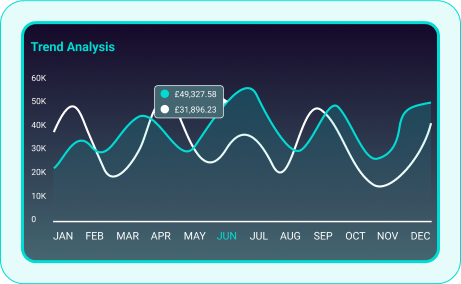

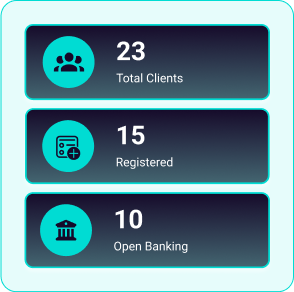

Check in on your client’s performance at any time, ensuring you can deliver timely and accurate advice based on real-time financial data that monitors their KPIs and overall financial health. Through our intuitive portal, you’ll have access to all of their data, consolidated and broken down into easy to understand reports.

Our real-time insights help to proactively identify trends, both positive and negative, allowing you to spot potential issues, and give the right advice as and when it is needed. Whether you’re tracking your client’s cash flow fluctuations or analysing their profitability trends, we’ll help you deliver the data driven advice that your client needs to succeed.

-

Instant access to client data from anywhere: Our 24/7 web-based portal lets you monitor your clients’ financial health in real-time, meaning you’ll always have the data you need to provide the right advice.

-

Proactive guidance: We’ll help you spot financial issues or beneficial trends early, and with them, you can offer proactive solutions to your clients to keep them on the right track.

-

Customisable platform: With Pulse you can view real-time data across multiple clients and industries, ensuring it’s easy to track performance and offer strategic recommendations.

-

Better client communication: With our actionable insights you can also engage clients as and when you spot trends, keeping them up to date with data that guides their business decisions.

-

Scenario analysis: Our fintech will help you run through different financial scenarios, in turn helping your clients assess potential market rundowns or internal inefficiencies, adding more value to your role as advisor.

-

Trend identification: Our platform also helps you identify the financial patterns of your clients over time, meaning you can predict future performance and support the long term growth of their business.

SAFEGUARD YOUR CLIENTS FROM FINANCIAL RISKS WITH REAL-TIME ALERTS.

Fraud detection and prevention

Our platform grants you access to powerful risk management tools that will help you monitor your clients’ financial data for signs of distress. From missed payments to declining cash flow, Pulse will provide real-time alerts that notify you of any potential risks, and allow you to quickly guide your clients through tough situations.

We support advisors in reducing their clients’ exposure to financial risks by continuously tracking their KPIs, allowing you a complete overview of their business health, and equipping you with the right data to offer the best strategic advice.

-

Real-time risk alerts: Our tool delivers instant notifications when financial risks emerge for your clients, such as cash flow issues or missed payments, helping you to act quickly and protect their interests.

-

Proactive risk management: Use our actionable insights to proactively guide your clients through financial challenges, offering solutions that will keep their business secure.

-

Continuous monitoring: By keeping track of your client’s key financial indicators, you can address any risks to their business before they become major issues.

-

Secure financial processes: Our fintech enables you to implement secure financial strategies for your clients to reduce their exposure to fraud and financial loss.

-

Detecting financial risks: Through our portal, you can quickly identify risks such as liquidity shortages or debt accumulation, and through our insights into liabilities and expenditure, keep your clients risk free.

HELP YOUR CLIENT SET MEASURABLE GOALS AND TRACK THEIR PROGRESS.

Enhanced client advisory services

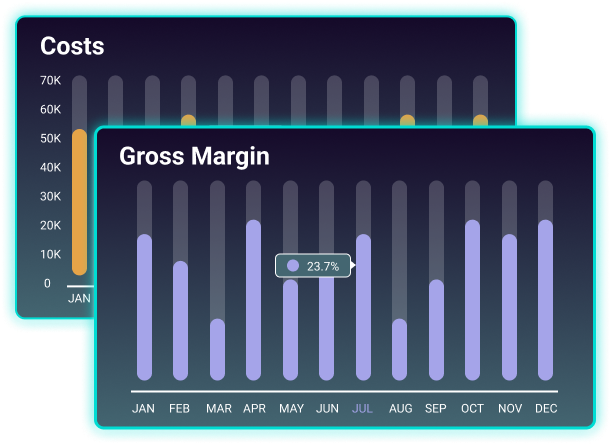

Guide your clients towards success by helping them set realistic, measurable goals with Pulse. You can establish key performance indicators based on their objectives, with anything from increasing revenue, to improving cash flow or reducing costs possible to track on our intuitive portal.

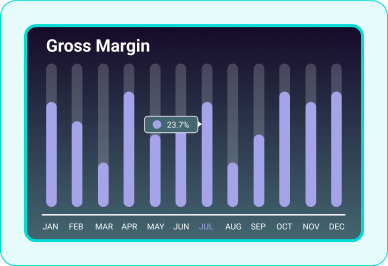

Our KPI tracking tools work in real-time, providing valuable feedback and allowing you to adjust strategies based on the actual performance data of things like growth rates and gross margin. Tracking KPIs in this way also helps to motivate your clients by giving them clear and measurable outcomes to work towards.

-

Custom KPI setting: Use Pulse to set financial goals with your clients, ensuring they align with their long-term objectives to help growth.

-

Real-time progress tracking: Our portal lets you monitor your client’s progress towards their goals, and because the data is all in real-time, it means you can help them stay on track with any necessary adjustments.

-

Data driven feedback: Pulse provides actionable insights based on performance data that will help your clients improve their strategies through measurable success.

-

Motivational client engagement: Keep your clients motivated and engaged by showing them easy to understand, trackable progress through our data hub.

-

Enhanced reporting: By tracking KPIs, our portal also helps you provide clear, measurable outcomes for your clients, helping them to set forward looking goals.

OFFER CUSTOMISED FINANCIAL SOLUTIONS TAILORED TO EACH CLIENT’S NEEDS.

Personalised client solutions

With Pulse you’ll gain access to detailed insights that cover your clients’ financial performances, meaning you can offer personalised solutions that align with their business goals. Whether they want to secure a new loan or are looking to adjust their current repayment schedules, you can guide them through their financial planning with their complete data at hand.

We’ll also help you strengthen client relationships by providing this personalised approach, delivering actionable insights that address their challenges, and with the real-time data we generate, you can offer the right solutions to enhance client satisfaction and drive their long-term success.

-

Tailored financial advice: With our insights, you can offer personalised recommendations that align with your client’s financial situation and business objectives.

-

Customisable loan structuring: You’ll help clients optimise loan terms and repayment schedules based on their financial capabilities, helping them reduce risk while improving their financial health.

-

Proactive client engagement: Use Pulse to stay ahead of your client’s needs, offering them timely and tailored solutions to their business challenges.

-

Strengthened client relationships: Our platform helps you build long term client loyalty by providing accurate, personalised financial solutions that adapt with the growth of their business.

-

Proactive corrections: By tracking all of your clients’ KPIs, you can suggest corrective measures to them before any potential problems worsen.

EMPOWER YOUR CLIENTS WITH DATA-BACKED FINANCIAL GUIDANCE

Data-driven decision making

Gain access to powerful insights that will help you guide your clients towards better financial decisions. Our platform consolidates real-time financial data from cash flow to expenses and allows you to provide accurate advice that is rooted in your client’s current financial situation.

Whether your clients are deciding where to invest or trying to figure out how to streamline their operations, Pulse will provide you with all the tools you need to help them make the most informed decisions for their business.

-

Informed resource allocation: We’ll help you help clients allocate their resources more effectively, delivering data driven recommendations based on their financial performance.

-

Risk management: Using real-time data you can identify your clients’ financial risks early, giving them the information they need to mitigate potential losses before they even rise.

-

Strategic growth planning: With Pulse, you can support your clients by developing long term growth strategies with them, based on insights into their market trends and financial benchmarks.

-

Scenario planning: You can use Pulse’s forecasting tools to model different financial scenarios for your clients and use them to support their decisions for scaling and investing.

SIMPLIFY CLIENT REPORTING WITH AUTOMATED MONTHLY ACCOUNTS.

Monthly management accounts

Pulse makes financial report management easy by automatically generating monthly management accounts that provide detailed overviews of your clients’ financial performance in easy-to-understand formats. Our reports cover key areas, including income, expenses, cash flow, and profitability, to deliver a clear image of their financial health.

Our automated reports mean you can focus on providing strategic advice to your clients rather than spending time compiling data, so whether it’s for tax planning or loan applications alongside their business strategies, we’ll ensure you’re always prepared with the most up to date information.

-

Automated reporting: We’ll help you save time with automatically generated monthly accounts, providing a detailed breakdown of your client’s financial health.

-

Clear financial overviews: Our monthly reports offer a thorough yet easy to understand summary of key financial metrics, including revenue, costs, and profit.

-

Informed decision making: Pulse has been built to help clients make smarter business decisions, based on easy to access, accurate, up to date monthly reports.

-

Reduced administrative burdens: You can free up your time by using Pulse, as we have automated the numbers, you can focus on offering valuable business advice, rather than focusing on manual ledgers.

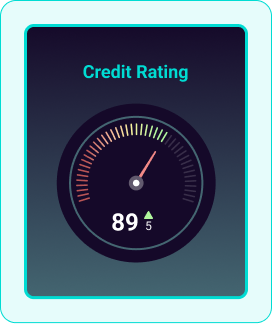

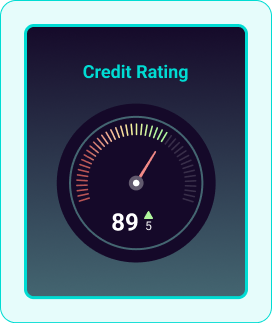

HELP YOUR CLIENTS IMPROVE THEIR CREDITWORTHINESS WITH DATA DRIVEN INSIGHTS.

Business credit score

By monitoring cash flow and profitability, along with other direct financial indicators, you can guide your clients towards a stronger financial standing, helping them to improve their business credit score and secure better loan terms, all while reducing any risk to ongoing credit.

By using Pulse to identify changes in client’s financial health, you can actively assess any risks that would affect their credit profiling, and by recommending ways to improve their financial standing based on the insights we provide, you can help ensure your clients build their creditworthiness over time.

-

Proactive credit risk management: Use the financial data Pulse provides to assess credit risk early, and provide your clients with the actionable advice they need to improve their creditworthiness.

-

Improved loan terms: Our platform helps your clients secure better financing by guiding them towards ongoing improved financial health, and improving their credit profile.

-

Monitored financial health: With Pulse you can track your clients’ cash flow, expenses, and profitability, to identify any risks that may have a negative effect on their credit standing.

-

Strategic financial advice: Through our intuitive portal you can provide data driven recommendations to your clients, helping to optimise their finances and strengthen their creditworthiness over time.

-

Credit risk identification: We’ll help you analyse your clients’ payment behaviours to predict potential cash shortages, giving them time to adjust and maintain their creditworthiness.

Industry Benchmarking

Debtor Analysis

Cashflow Forecasting

Pulse GPT

How it works

Register in minutes and connect your clients’ finances to Pulse for immediate real-time cash flow insights. Follow the steps below to get started.

Join Pulse using our quick and easy registration process

Invite your clients and get your portfolio set up in a few clicks

Guide your clients to seamlessly connect their bank accounts and accounting software

Access your complete client portfolio and see real-time updates from the moment you log in

View business goals set by your clients and track their progress to provide expert guidance

Safe and secure, as it should be

Built on trusted protocols and certified by Cyber Essentials Plus, we make it our priority to deliver class-leading security. Leveraging the power of Microsoft Azure, Pulse ensures your data is managed on a secure, reliable, and scalable platform. We protect your financial information with comprehensive encryption, both at rest and in transit, and employ stringent security measures such as multi-factor authentication, geo-fencing, and IP restrictions to block unauthorised access.

Explore NowEvery device and user in the Pulse network benefits from enhanced protection through Microsoft Entra ID, guaranteeing the security of your digital identity at all turns.

Who we work with

At the heart of Pulse, we work with some of the market leading technology and service providers to deliver the best product capabilities and solutions for SMEs. Whether you’re looking to streamline operations, enhance your marketing strategies, or explore new financial technologies, our marketplace is your gateway to a world of expertise.

Explore NowBe a part of our Partner Ecosystem

Join UsWhy work with us?