Efficiency today in the competitive business environment is not a luxury but a requirement. To most SMEs in the UK, handling finances often feels like a balancing act. Hundreds of spreadsheets, receipts, and invoices are always screaming for attention. Ever wondered how some businesses seem to have it under control while others struggle? It is often in the tools they use.

Welcome to the world of accounting software, where robotics and innovation are rapidly changing accountancy workflows to free up valuable time and resources. What, therefore, is transformational about these digital solutions, and particularly, how would SMEs benefit from them?

Let’s explore.

Accounting Software Explained

Accounting software is generally a tool for businesses that helps record and track transactions, making it a tool for managing their finances. Basically, most of the tasks that are repetitive, otherwise done manually by an accountant or a bookkeeper, such as tracking payments, organising transactions, and generating financial reports, can be taken care of.

In this regard, accounting software automatically performs such processes, thereby saving time and money, providing clear insights into making financial decisions, reducing the need for extended physical storage, and simplifying audits and tax investigations by making previous financial records easily available.

Evolution of Accounting from Manual Processes to Automation

Accounting was mostly conducted through spreadsheets, which took time and were error-prone. Competition increased the demands for regulations, thus bringing about the necessary changes.

In this context, accounting software automatically executes such processes, thereby saving time and money, providing clear insights into making financial decisions, reducing the need for extended physical storage and simplifying audits and tax investigations by making previous financial records easily available.

The Role of AI in Accounting Transformation

In a study, Sage revealed that the accounting industry is poised for significant transformation. Widespread AI adoption could add £2 billion to the UK GDP, boost exports by £238 million, and create nearly 20,000 jobs. The accounting sector, already a major contributor with £33.3 billion added to GDP and 323,000 employees, stands to benefit greatly from AI advancements.

The Department for Science, Innovation and Technology has highlighted the importance of tech and AI adoption for economic growth, with Sage’s report suggesting that AI adoption could double in the next five years if embraced by accountants and bookkeepers.

Ten Reasons Why SMEs Must Use Accounting Software

#1 Improved Financial Accuracy

Accounting software provides the accuracy of financial records with minimum manual errors since most calculations and error-checking properties are automated.

#2 Cost Efficiency

Accounting software is cost-effective in that it reduces overall operational expenses by reducing the need for outsourced bookkeeping and costs related to paper and printing.

#3 Advanced Security Features

Secure Password protection and encrypted cloud storage guarantee protection against unauthorised access to sensitive financial information and destruction in case of natural disaster.

#4 Efficient Data Synchronisation

The software offers accounting integration and quick access to financial data across different platforms, making it easier to migrate and update data in real-time.

#5 Streamlined Tax Compliance

Tax planning, receipt storage, and policy integrations make filing and preparing taxes easier and save more time.

#6 Automated Record-Keeping

Software solutions automatically compile, analyse, and report financial data, reducing manual effort and improving the ability to track revenue trends.

#7 Automated Invoicing

Automation tools for creating, sending, and tracking invoices ensure timely payments while reducing the administration time required in invoicing.

#8 Bank Statement Reconciliation

The integration of bank accounts permits the automated reconciliation of transactions for better accuracy and efficiency involved in financial management.

#9 Facilitated Accountant Collaboration

With accounting software hosting central financial data, collaboration with an accountant will be easy, sharing information hassle-free, and one would have reduced document preparation time.

#10 Accessible Financial Data Anytime

Cloud accounting software offers financial data access from any device with internet connectivity that helps make a business manager decide on the go.

How Can Pulse Help SMEs with Accounting?

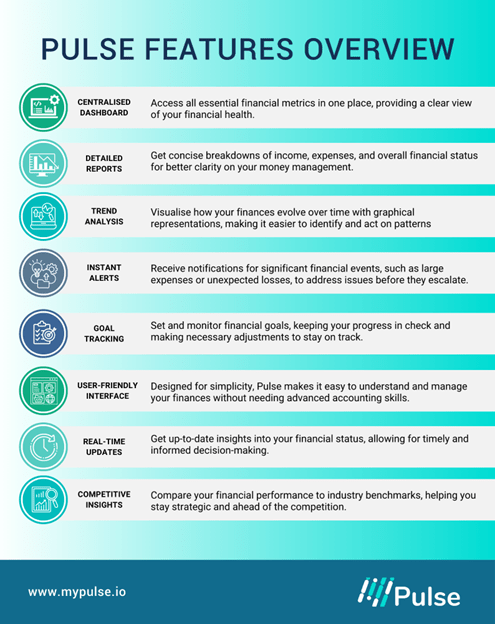

Pulse makes it possible for SMEs with big ambitions to take their financial management to the next level. Designed to make your life easier and help you understand your business finances more easily, Pulse will be an essential financial companion.

With the help of Open Accounting and Open Banking, Pulse consolidates all your financial data into a single platform: your income, expenses, profits, and trends. It allows clear and real-time insights through very user-friendly reports, so you can make informed decisions quickly and maintain efficient expense management to outclass your competitors.

Pulse puts all the information you need right at your fingertips through an intuitive portal, detailed reporting, graphical trend analysis, and goal tracking. Be it an SME, business advisor or accountant, we empower you with accessible and actionable financial intelligence.

Summing Up

As technology transforms business operations, accounting software, particularly innovative solutions like Pulse, offers SMEs a way to transform complex financial data into actionable insights. These tools empower businesses by providing more concise reports that are easy to understand, real-time analytics, and automation of routine tasks so as to let them not just keep pace but really excel.

Why be buried under spreadsheets when you can see the big picture and make strategic moves? The future of your business lies in harnessing the power of digital tools, and Pulse is here to lead the way.

Email us at info@mypulse.io to start your journey with Pulse today!