As embedded finance continues to reshape the financial ecosystem in 2025, digital lending is undergoing a transformation that demands more than just speed. It requires intelligence, automation, and infrastructure-level reliability. Pulse has developed a comprehensive suite of API-based lending solutions encompassed in Pulse’s Unified Lending Interface (ULI) that don’t just plug into ecosystems; they power them.

Whether you’re an aggregator launching a digital credit marketplace, a lender optimising origination workflow, or a bank integrating end-to-end lending capabilities into your digital stack, Pulse’s ULI gives you the easy-to-integrate modular tools you need to stay ahead.

Here’s your inside look at everything Pulse’s ULI offers, and how it can supercharge your lending ecosystem from top to bottom.

What is the Pulse ULI?

Pulse’s Unified Lending Interface is a unified infrastructure layer that connects six powerful solutions under a single, user-friendly and developer-friendly interface:

- Pulse LOS (Loan Origination System)

- Pulse LMS (Loan Management System)

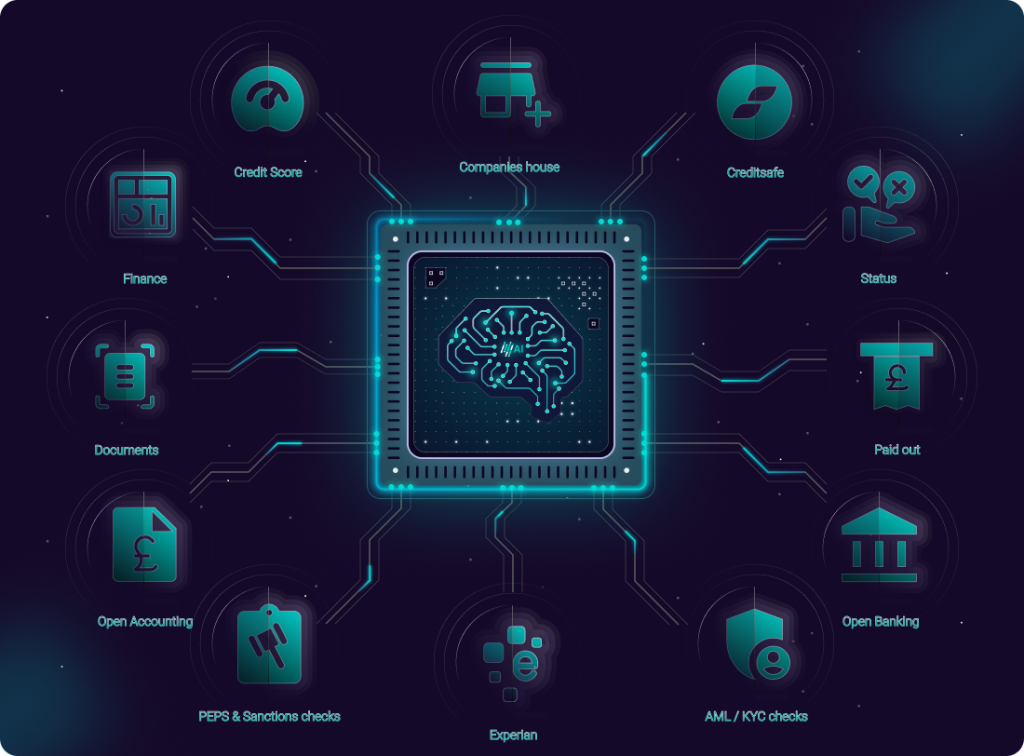

- Einstein aiDeal (Automated Underwriting Solution)

- DebtorIQ (Accounts Receivable Module)

- aiPredict (Cash Flow Forecasting Module)

Each of these is purpose-built to accelerate and streamline every stage of the credit lifecycle from origination and underwriting to risk intelligence and ongoing loan management.

Let’s explore each component and how it serves aggregators, lenders, and banks alike.

Pulse LOS: Loan Origination System

A frictionless loan origination system is the cornerstone of modern lending.

Pulse’s LOS handles:

- Fast, efficient and compliant loan processing

- Smart eligibility checks

- Application time reduced to under 3 minutes

- API-enabled document collection

- Real-time scoring and auto-decisioning deals when paired with Einstein aiDeal Deal

Use Cases:

- Aggregators can send a single application to several lenders seamlessly

- Lenders can use the Pulse LOS to expedite and automate the loan origination process

- Banks can integrate Pulse LOS into their existing systems for end-to-end digital onboarding

Why it matters: No-code configurability meets deep API control. The Pulse LOS is modular, making it easily accessible with enterprise-grade tech for leading banks.

Einstein aiDeal – Automated Underwriting System

Einstein aiDeal is Pulse’s AI-powered decisioning engine. Capable of handling massive volumes, it can decide 90% of deals in less than 60 seconds with customisable criteria that can be altered as and when required. Minimal manual intervention.

Einstein aiDeal offers:

- Customisable lending criteria

- Instant underwriting and decisions

- Capability of scaling volumes and decisioning thousands of deals in seconds

- Cut costs, save time and enhance capacity

- Superior customer experience

Use Cases:

- Aggregators can reduce processing times and reduce human error

- Lenders can reduce credit risk while improving approval rates

- Banks can automate underwriting and gain insights into neglected small businesses for financial inclusion.

Why it matters:

Einstein aiDeal dramatically cuts decision times to less than 60 seconds, all while maintaining speed, accuracy and compliance.

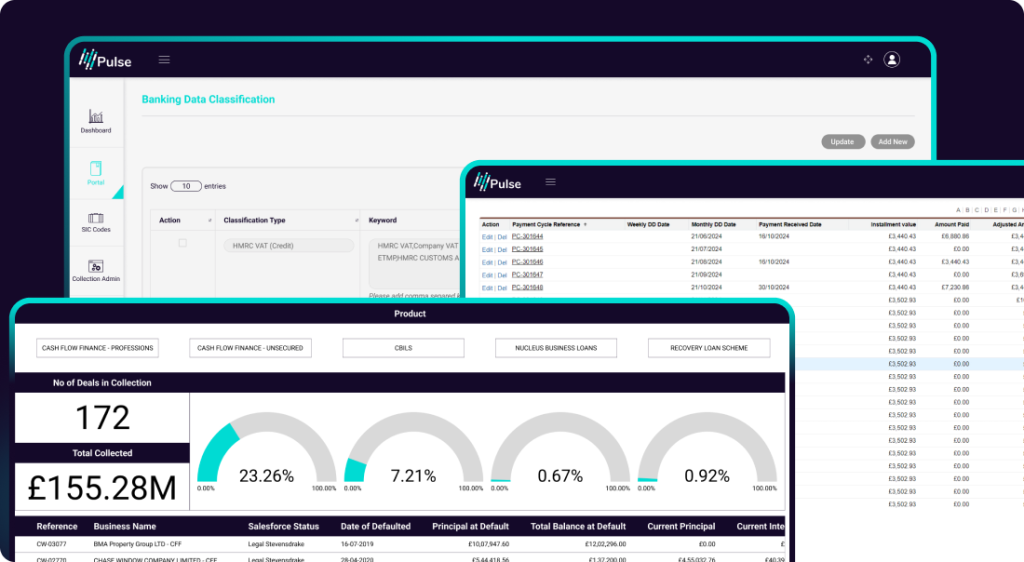

Pulse LMS – Pulse Loan Management System

Once loans are disbursed, managing them efficiently and staying compliant is critical.

The Pulse LMS provides:

- Recovery of overdue payments

- Management of defaults

- Seamless tracking of repayments

- 360-degree customer communications and reminders

- (Includes e-mail, SMS, phone, notifications) for coordinated collection efforts

- Advanced reporting and analytics to track and enhance collections

Use Cases:

- Aggregators can track multiple client loans simultaneously and not worry about repayments, follow-ups or defaults.

- Lenders gain the means to reduce loan defaults and automate the collections process.

- Banks benefit from seamless integration into their core systems with a seamless collections process.

- Why it matters: Pulse’s LMS bridges traditional credit servicing with next-gen automation. This means you can scale exponentially while saving on staff costs, operational costs and upfront infrastructure.

Pulse’s DebtorIQ – Accounts Receivable Solution

If you’ve ever struggled with accounts receivable, you’ll appreciate DebtorIQ, an intuitive tool built to help monitor, streamline and control accounts receivable.

DebtorIQ offers:

- Tracking pending payments and invoices

- Categorise debts into time buckets (30,60, 90 days) to highlight risks and overdue payments

- Visualise invoices raised against actual payment receipts

- Monitor credit scores

- Analyse key metrics such as Day Sales Outstanding (DSO), credit limits and invoice fluctuations

- Track critical information such as CCJs, new directors or filed accounts for informed credit decisions

Use Cases:

- Aggregators can gain deeper insights into default risk by tracking receivables of potential borrowers.

- Lenders can track the receivables of multiple borrowers, giving them insight into actual cash flow, liquidity and payment behaviour.

- Banks can embrace a customer-centric process and track borrowers’ financial situation to determine loan-repayability.

Why it matters: DebtorIQ turns accounts receivable into a strategic tool, offering real-time insights into borrower liquidity, payment behaviour and critical information.

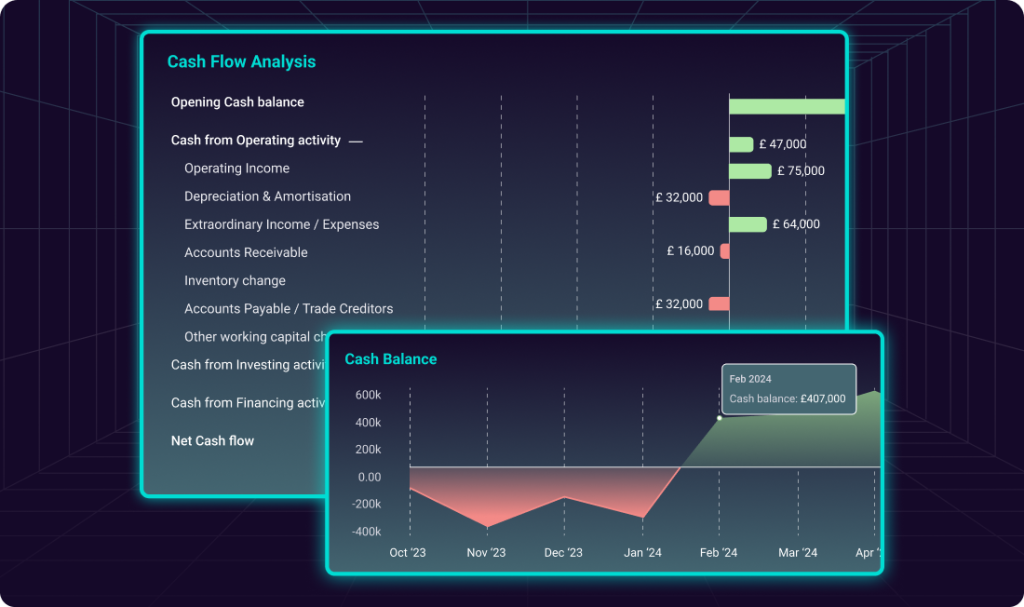

Pulse’s aiPredict – AI Driven Forecasting and Scenario Modelling

Pulse’s aiPredict gives users access to advanced predictive analytics, cash flow forecasting and scenario modelling. Plan for the future and adopt a predictive approach rather than a reactive one.

aiPredict enables:

- Cash flow forecasting using advanced predictive analytics

- Real-time single variance forecasts

- Stress tests and simulations

- Transform historical data into 12-month balance sheet, P&L and cash flow forecasts

- Detailed cash flow analysis, including net cash flow, cash balances

- Monitor liquidity in real-time

- Customisable cash flow assumptions

- Select forecast time periods: monthly, quarterly or yearly forecasts

Use Cases:

- Aggregators can forecast revenue and commission pipelines

- Lenders can use it to make informed funding allocations and gain deeper insights into borrower liquidity and cash flow. Banks can use aiPredict to monitor the real-time cash flow of customers and gauge loan repayability.

Why it matters: aiPredict turns historical lending data into an actionable predictive engine. Analyse cash flow in great detail with scenario modelling and customisable assumptions.

Pulse’s Embedded Finance Value Proposition: Supporting Aggregators, Lenders & Banks

For Aggregators

Pulse enables plug-and-play integration into your lending marketplace, powering everything from loan applications to credit scoring to collections. You don’t need to build the engine; we provide the APIs so you can focus on growth.

Key Value: Speed to market, cost efficiency, superior user experience.

For Lenders

Use Pulse to transform your tech stack without rebuilding from scratch. Our modular API lets you start with what you need: LOS, LMS, or underwriting decisioning. Expand as you grow.

Key Value: Reduce risk, improve approval speed, automate servicing.

For Banks

Embedded lending has moved from innovation to necessity. With Pulse, banks can embed end-to-end lending journeys into existing systems seamlessly and automate compliance.

Key Value: Full control, enterprise security, future-proof infrastructure.

The Pulse Guarantee

With Pulse’s Unified Lending Interface, you don’t just get technology, you get a reliable partner. Our developer-first documentation, ISO 27001:2022 certification, dedicated support teams, and enterprise SLA make us the preferred partners for next-gen lending solutions.

Whether you’re building a new lending product or reimagining your entire credit ecosystem, Pulse is ready to support your journey. To learn more, book a demo today.

Related Blogs