Knowing how well your business is doing with money isn’t just about looking at numbers on paper. It’s about seeing what chances you might have in the future, avoiding problems, and making sure your business stays strong.

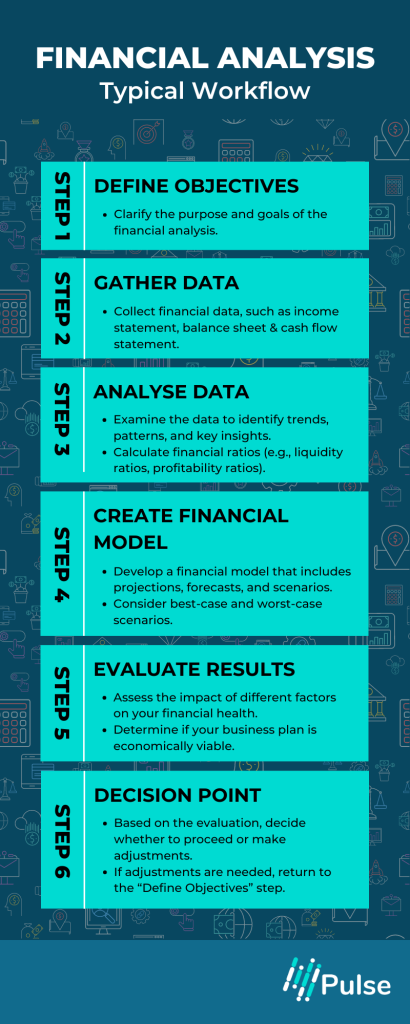

Financial analysis helps with this. It involves looking closely at all the money coming in and going out of your business, including your plans and spending.

Importance of Business Financial Analysis

Conducting financial analysis is vital, as it highlights the performance of the business and the financial health of assets. It can also identify potential opportunities, predict profitability and identify the possible risks. When done correctly, financial analysis will provide you with enough information and time to protect your business from foreseeable risks, conduct competitor analysis, create profitable strategies and make informed decisions.

A proper financial analysis report can boost your credibility among investors, stakeholders, and other financial institutions, and it can provide you with funds needed for purchasing equipment, business growth plans, expansions, mergers, acquisitions, and other activities to meet your business goal.

Core Components of Finance Analysis

Financial analysis comprises several key components to evaluate an organisation’s economic health and stability.

Financial Statements

Financial statements consist of 3 critical elements: a balance sheet, an income statement, and a cash flow statement. These statements provide a snippet of the company’s current financial performance and assist in developing strategies that align with business goals.

Financial Ratio Analysis

It encompasses a set of various metrics to critically analyse and provide extensive insights into a company’s financial performance, which also comprises debt-to-equity, profitability, liquidity, and financial leverage ratios.

These measures help each business with information that analyses or reviews the ability to meet the company’s short-term obligations, look for areas to improve, make profits, and enhance shareholder value.

Trend Analysis

This entails comparisons and analyses of data on a current basis with the historical data to find trends and patterns in key financial metrics such as revenue growth, managing expenses, and profitability. Comparing this data assures financial stability by underlining the aspects that need improvement and those that work fine.

Comparative Analysis

Comparative analysis enables companies to compare their historical performances with those of their competitors. This comparison allows them to set a benchmark for themselves. Evaluating various performance metrics, such as profitability margins, can help determine their strengths, weaknesses and competitive positioning.

Risk Analysis

This includes the identification and evaluation of various types of financial risks: liquidity, credit, market, and operating risks. These risks can influence the economic stability within a company, and perhaps a risk analysis will keep the businesses away from any impending vulnerabilities and help them make better decisions.

Qualitative and External Factors

This includes analysis of non-financial and external factors such as management quality, brand reputation, trends, economic conditions, regulatory changes, and market dynamics that can impact financial performances.

Benefits of Pulse for Financial Analysis for Small Business

In this technologically advanced era, financial analysis tools such as Pulse play a crucial role for small businesses by providing them with the essential tools required to make informed decisions. The Pulse portal organises large amounts of data in an easy-to-read format, emphasising the company’s highs and lows.

Comprehensive Financial Reporting

Pulse structures payroll processing, accounts payable/receivable, and general ledger management in one secure cloud-based platform that provides full security of data and compliance with standards, including GDPR.

Real-Time Updates and Scalability

This provides immediate access to updated financial insights, which is essential for evaluating performance metrics and making time-sensitive decisions.

Open Banking Integration

Open banking facilitates smooth functioning with financial institutions by providing access to real-time data, automated transaction feeds, and expedited reconciliation procedures. It helps paint a precise picture of the company’s well-being.

Open Accounting

Open accounting facilitates smooth functioning among the stakeholders and ensures compatibility across different financial systems by supporting standardised data-sharing protocols. It enables the reduction of manual errors and accelerates reporting cycles.

Advanced Analytics Tools

With Pulse’s AI-driven system, the churning and analysis of data become easier, facilitating forecasting, planning, optimising resource allocation, and leveraging strategic decision-making.

Security Measures

Utilises encryption, secure data centres, and compliance with data protection regulations to ensure data integrity and confidentiality, instilling confidence in stakeholders.

Summing Up

“The best financial models are simple enough for anyone to understand, yet dynamic enough to handle complex situations.” — Tim Vipond.

A well-conducted business financial analysis is crucial in providing essential insights to stay ahead of the competitive marketplace, leveraging data-driven decision-making.

Financial analysis is not just about crunching numbers; it is a strategic tool that exhibits business performance. The more detailed the analysis, the more successful your venture will be in understanding accounting principles. Conducting financial analysis at regular intervals and opting for a financial expert’s help are a few of the best practices small businesses must follow to thrive in a competitive landscape.

Sign up to Pulse today to bolster credibility and make informed decisions that propel your business forward.

0 Comment