Cash Flow Forecasting: Strategies, Challenges, Formulas, and Automation

Some businesses sail on even in crisis-ridden tough markets while some barely survive a day. This could be seen, often, as sound cash flow forecasting. Predicting cash flows with confidence enables businesses to avert crises and seize growth opportunities.

In today’s volatile financial landscape, effective cash flow management is the real deal for success or failure. Accurate cash flow forecasting gives the means to ensure liquidity, make informed decisions, and provision for large-scale stability. Now, let us dive deeper into this.

What is Cash Flow Forecasting?

Cash flow forecasting estimates the movement of finances over a specified period. Companies can anticipate potential cash shortages or surpluses. Accurate forecasting allows proactive financial management, guaranteeing liquidity to meet obligations. This encourages informed financial decisions and maintains business continuity.

By shedding light on your business’s financial trajectory, cash forecasting plays an essential role by shedding light on the company’s financial status. This also helps in budgeting, investment planning, and crisis management which ensures staying ahead of uncertainties.

Why is Cash Flow Forecasting Important?

Ensure Liquidity

An accurate forecast can help a business, especially a small and mid-sized enterprise, predict its cash inflows and outflows. Doing so will ensure that the SME has enough funds to cover their expenses, e.g., to pay their employees, keep their vendors happy, or service a loan. This helps ensure that a liquidity crisis or financial disruption rarely arises.

Improve Decision-Making

A clear picture of cash availability and forecasts empowers businesses to make informed decisions about investments, operational expenses, and growth strategies. This includes determining when to delay expenditures or take on debt strategically.

Identify Risks Early

Forecasting helps to identify any cash gaps or surpluses in advance. A proactive effort could include a cost-cutting initiative, renegotiation of payment terms, or acquiring short-term financing to help overcome challenges.

Plan for Growth

Companies can efficiently allocate resources for long-term goals like market expansion, product development, or staffing. This ensures that growth initiatives are backed by robust financial planning.

Improved Stakeholder Confidence

A good cash flow projection shows that a company is disciplined in terms of finance and foresightful in terms of strategy, thereby creating trust from investors, lenders, and other stakeholders. Funding opportunities and building engagement require projections.

Enhanced Financial Control

By offering a transparent view of financial health, management can proactively take preventive measures, maintain optimal cash reserves, and ensure uninterrupted operations.

Risk Mitigation

Anticipate potential financial shortfalls early, enabling business owners to devise crisis management strategies. For instance, businesses can arrange credit lines, negotiate supplier terms, or adjust expenditures to bridge gaps.

Optimised Resource Allocation

Companies can prioritise the areas to fund, that provide the maximum ROI, such as technology upgrades, expansion to new markets, or marketing efforts.

Increased Flexibility and Preparedness

Such enablement allows businesses to stay flexible in their operations by making quick adjustments to changing market conditions or unexpected challenges, increasing resiliency even in an economic downturn.

Support for Strategic Planning

Long-term forecasting gives insight, which could help in the decision-making process concerning extremely large, complex financial decisions: capital expenditures, mergers, acquisitions, and important investments. Thus, the organisation is ensured to be ready financially and to seize opportunities whenever they arise.

Types of Cash Flow Forecasts

Cash flow forecasts can be tailored to meet various business needs, spanning different timeframes:

| Type of Forecast | Description |

| Short-term | Focused on periods ranging from days to weeks, essential for managing immediate liquidity and ensuring day-to-day operations run smoothly. |

| Medium-term | Covers several months, helping businesses align operational planning with working capital requirements for better mid-range financial adjustments. |

| Long-term | Helps you plan years ahead for growth, investments, and sustainability. |

Key Performance Indicators (KPIs) for Effective Cash Flow Forecasting

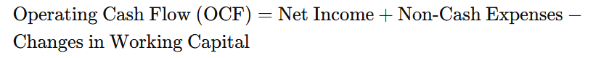

Operating Cash Flow (OCF)

Definition: OCF shows how much money a company makes from its core business alone.

Formula:

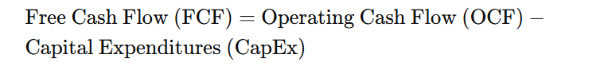

Free Cash Flow (FCF)

Definition: FCF is the money left over after a company pays for new equipment and other items needed to run and grow the business.

Formula:

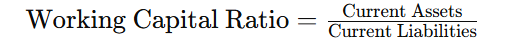

Working Capital Ratio

Definition: This shows if a company has enough quick assets to pay its soon-due bills. It helps show if a business can pay what it owes right now.

Formula:

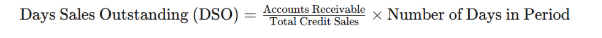

Days Sales Outstanding (DSO)

Definition: DSO shows how many days it takes a company to get paid after making a sale. When this number goes up, it means customers are taking longer to pay.

Formula:

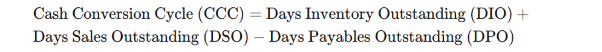

Cash Conversion Cycle (CCC)

Definition: CCC shows how fast a company turns its stock into actual cash. A faster cycle means the company is better at turning goods into money quickly.

Formula:

Where:

- DIO is how many days items sit in stock before being sold.

- DPO is how many days the company waits before paying its bills.

Formulas for DIO and DPO:

Techniques and Best Practices for Cash Flow Forecasting

3-Way Cash Flow Forecasting

Combining all three financial statements, the income statement, balance sheet, and cash flow statement – into one integrated overview provides for one’s observations of the company’s financial health. The integrated view provides cash flow guidance while emphasising the interrelationship of revenues, expenses, and capital expenditures. The cash position of the company becomes clearer and more accurate.

Rolling Cash Flow Forecasts

A rolling cash flow forecast updates forecasts based on real-time data and actual financial performance. In contrast to static forecasts, rolling forecasts generate new projections for a business, monthly or quarterly. This allows them to remain nimble in the wake of ever-shifting market conditions and sudden challenges. This approach actually helps prepare businesses for the future and make decisions that lead to better outcomes.

Scenario Analysis

Scenario analysis examines various possible scenarios and how they’ll affect the bottom line using different assumptions or market conditions. It allows companies to build capacity for these different scenarios, be it a recession or a spike in sales. By exploring a range of scenarios — best case, worst case, and most likely — companies can build more resilient strategies and respond nimbly to fundamental changes.

Common Challenges in Cash Flow Forecasting and Effective Solutions

| Challenge | Solution |

| Inaccuracy in Forecasting | Improve data quality and assumptions by using more accurate, updated information and automating the forecasting process. AI-driven tools and integration with financial systems can enhance forecast accuracy. |

| Cash Flow Volatility | Mitigate volatility through scenario planning, rolling forecasts, and continuously monitoring KPIs like DSO and CCC. Adjust strategies based on real-time data. |

| Complexity of Forecasting | Simplify the forecasting process by using specialised software and automation tools that reduce manual effort and minimise errors. ERP systems can consolidate financial data for easier forecasting. |

| Unforeseen Market Conditions | Use scenario analysis to prepare for different market conditions, like economic downturns or sudden increases in sales. Develop flexible strategies that can adapt to these changes. |

| Data Integration Issues | Utilising advanced predictive software that will allow importation of data from various departments across investments makes for a truly insightful forecast. |

| Lack of Real-Time Data | Leverage cloud-based systems and AI tools for real-time data processing and instant cash flow updates, ensuring more accurate and timely predictions. |

| Limited Financial Expertise | Invest in training or hire financial experts who understand the nuances of cash flow forecasting. Specialised consultants or AI-powered systems can also support accurate forecasting without requiring deep financial knowledge. |

Industry Trends Shaping the Future of Cash Flow Forecasting

1. Digital Transformation in Financial Forecasting

Digital transformations for financial planning and analysis involve technologically advanced solutions, including artificial intelligence, machine learning, and predictive analytics. These solutions assist organisations from cash flow forecasting to larger data set analyses and ultimately more precise forecasts.

2. Innovations in Financial Forecasting

There has been a growing dependency on predictive analytics to forecast trends based on past performance. It has also been introduced as a means of providing the enhancement of transparency and security concerning financial transaction processes to enable companies to optimise their cash flow forecasting processes.

3. Emerging Technologies for Real-Time Cash Flow Analysis

Thanks to cloud-based solutions and AI, emerging technologies are making way for real-time cash flow analysis to be more practical than ever. These tools enable businesses to monitor their financial well-being more closely, offering real-time insights into cash flow trends.

4. Sustainability and ESG Focus

ESG (Environmental, Social, and Governance) concerns are on the rise; companies are factoring these into their financial planning and forecasting. Companies will likely form cash flow strategies based on sustainable practices, affecting investment decisions and long-term financial planning.

Streamlining Cash Flow Forecasting with Pulse

What’s more, automating cash flow management can be a game-changer, and we are here to support you. Integrating directly with Open Banking and Open Accounting, the Pulse platform provides a clear view of your finances. Contact info@mypulse.io for a demo today!

Real-Time Financial Analysis

Pulse connects to your accounting software to show you up-to-date information about your cash flow, inventory, and finances.

Business Snapshot

Pulse offers instant visibility into sales trends, gross margins, and Open Banking/Accounting integration.

Management Accounts

With detailed, downloadable Profit & Loss and Balance Sheet reports, Pulse enables comprehensive financial analysis.

Customised Reports

Pulse generates detailed reports based on critical metrics, such as asset turnover ratios and debt service coverage ratios.

Automated Alerts

Stay informed with alerts for critical financial events, such as liquidity thresholds or loan repayment deadlines.

Integrated Dashboards

Pulse’s interactive dashboards help accountants and business owners visualise data and present financial strategies effectively.

Let Pulse be your trusted partner in achieving financial clarity and success.

Related Blogs