Navigating the Ups and Downs: Strategies for Effective Cash Flow Analysis in Your Business

Understanding and managing cash flow is crucial for any small to medium-sized enterprise (SME). We will take you through effective cash flow strategies with objectives that can mean the difference between success and failure in business. This article demystifies cash flow analysis and points out the importance of providing actionable strategies to help SMEs achieve growth and stability.

Understanding Cashflow Basics

The fundamental building block of financial management is cash flow analysis. You can gain valuable insights about income and spending which would help determine financial health. These insights are more intuitive and go beyond regular statistics. Analysing these flows would help businesses make informed decisions by identifying opportunities and isolating challenges. This approach helps gear the business towards growth and stability while ensuring resilience in the face of economic adversity beyond simply balancing books.

Cashflow refers to the movement of money, be it both inwards or outwards. This movement can be classified into three major segments.

| Component | Description |

| Operating Cash Flow | Cash generated or used in the normal course of business operations. Includes: |

| – Sales revenue | |

| – Payments to suppliers and vendors | |

| – Salaries and wages | |

| – Rent and utilities | |

| – Inventory purchases and changes | |

| – Other operating expenses | |

| Investing Cash Flow | Cash flows related to buying and selling long-term assets. Includes: |

| – Purchase of property, plant, and equipment | |

| – Proceeds from the sale of assets | |

| – Investments in securities or other companies | |

| – Other long-term investments | |

| Financing Cash Flow | Cash flows related to financing the business’s operations. Includes: |

| – Proceeds from issuing equity (e.g., shares) or debt (e.g., bonds, loans) | |

| – Repayment of debt (e.g., loan repayments) | |

| – Dividends paid to shareholders | |

| – Share repurchases (buybacks) | |

| – Other financing activities |

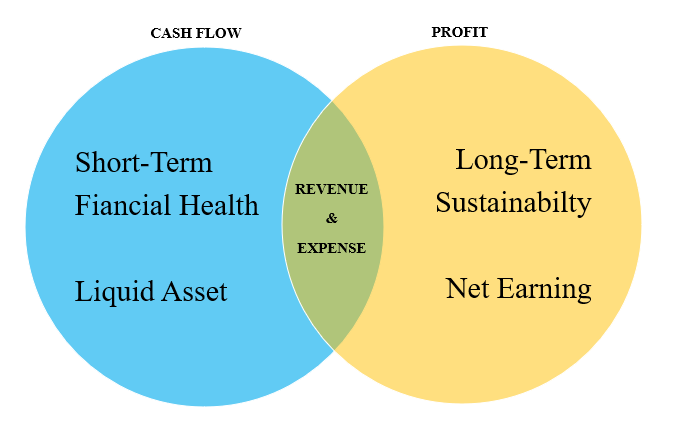

Businesses often confuse cash flow for profit. Understanding this distinction is essential. Total revenue minus business expenses is profit. Cash flow is a separate process and distinct from profit. Studying cash flow and profit can help a business understand its liquidity and plan ahead. Below is a chart that explains how cash flow and profit are intervened based on revenue and expenses and techniques for SMEs to stay solvent and profitable.

To ensure that the business can navigate the ups and downs of the financial cycle, effective cash flow management is crucial. Businesses can also harness the same to achieve the following:

Monitoring cashflow: Keeping tabs on the inflow and outflows of cash helps give a clear picture of monetary liquidity. This would include analysing sales revenue, investments, operating costs, taxes and loan prepayment to help ascertain said cash liquidity.

Forecast and Budgeting: Developing precise forecasts and budgets streamlines the task of anticipating upcoming cash flows with the use of historical data, market patterns, and company strategies. This allows for making decisions in advance and being better ready for financial changes.

Managing work capital: Properly handling working capital, which is made up of current assets and liabilities, ensures adequate liquidity to sustain continuous business activities without having to rely on external business funding.

Cash flow ratio and metrics: Financial ratios that provide information about liquidity and solvency levels, such as the current ratio and quick ratio, can be used to make informed assessments of financial health.

Implementing the strategies mentioned above would allow companies to effectively handle their cash flow, minimise financial risk, take advantage of growth opportunities, and establish stability in an evolving economic environment.

Cash Flow Management Strategies.

Improve Account Receivable:

- Establish credit policies.

- Invoice promptly and accurately.

- Offer incentives for easy payment.

Optimise Account Payable:

- Negotiate payment terms.

- Leverage discount.

- Monitor and prioritise payments.

Manage Inventory Efficiency:

- Implement an inventory control system.

- Optimise reorder points and order qualities.

- Reduce obsolete inventory.

Common Cash Flow Issues: SMEs often encounter several common cash flow problems.

Delayed Payments:

Getting paid on time by your customers or clients is extremely important. When incoming payments are delayed, you may find it difficult to pay vendors, employees or manage operational expenses.

Overtrading:

Its important that you don’t stretch yourself too thin. Overtrading has often led to the downfall of many successful businesses. Always remember to maintain sufficient cash reserves, and slow and steady wins the race.

Poor expense management: Ineffective cost control can drain cash unnecessarily, reducing personality.

Symptoms of poor cash flow management include:

- Frequent overdrafts.

- Overdue payments.

- Lack of cash revenue.

- Failure to capitalise on growth opportunities due to cash flow restrictions.

Cash flow dynamics:

Pulse interface forecasts cash flow projects’ future cash flow using traditional data. It generates data based on trends that can help predict the future available on peaks and troughs, allowing proactive management and strategic decision-making. The key ratios, such as the current ratio (current assets divided by current liabilities) and the quick ratio (liquid assets divided by current liabilities), shed light on your company’s liquidity and ability to meet short-term obligations with the help of the pulse tracking tool you can leverage that can unlock the potential and gain insight by safe integration of open banking for cash flow

analysis that aggregates the average in and outflow of the money in your business and can support you to expand your business.

Tips for SMEs for optimising revenue streamers:

Every SME has the advantage of making data-driven decisions based on statistical insight generated on a statement that encourages you to guide your client based on estimated cash flow data and utilise the benefit.

- Diversify your offering by exploring goods and services that complement your existing offerings. This may attract customers and encourage new clients to make larger purchases.

- Segmenting customers based on purchase patterns, demographics, and needs helps you maximise engagement and converse into customised sales and marketing strategy.

- Improving customer relationships is vital to creating loyal customers by providing quality experiences.

- Implementing dynamic price strategy with the help of data analytics in response to changing consumer demand, modifying prices with rival prices, and discount strategies to gain new customers.

- Reduce expenses, simplify operations without sacrificing quality, and identify gaps and operations to gain profit along with a general situation that benefits both.

- Investing in digital marketing to reach a wider audience and achieve success with the help of online platforms, such as social media, email marketing, or advertisement, may encourage the audience to understand the brand and to provide asper demands based on trends and seasons.

For hypothetical analysis, imagine a manufacturing SME using Pulse to implement robust cash flow forecasting. Through precise cash flow forecasting during seasonal sales dips, the business obtains a line of credit ahead of time, guaranteeing uninterrupted operations.

A thorough understanding of financial rhythms is necessary to manage a business’s cash flow ups and downs. Effective cash flow management enables businesses to weather uncertainty and capture opportunities using strong analytical tools and proactive strategies. Businesses can successfully manage the labyrinth of cash flow management by harnessing strategic foresight and insightful analysis to create a robust, resilient and growth oriented business.

In conclusion, your business can benefit and embrace rapid growth provided you understand the nuances of cash flow management. Pulse is a comprehensive tool that would help you achieve this along with detailed real-time business analytics. From improving cash-flow to understanding critical data about your business, you can take informed and swift decisions to expedite business growth. A healthy cash flow would enable rapid and sustainable expansion which you can monitor at the click of a button.

Related Blogs