Top 5 Ways Debt Analysis Can Help SMEs Boost Financial Health

Debt analysis is an essential financial tool for business entities, especially SMEs, to be on top of liabilities and have healthy cash flows. Analysing the most important metrics will allow the SMEs to understand the depth of debt obligations and recognise risks. This enables SMEs to make informed decisions about optimising financial health. It will help in avoiding a halt in cash flows, prevent cash flow disruption, and manage credit risk.

What is Debt Analysis?

Debtor analysis is a very important part of debt management, which focuses on tracking the receivables of a company—amounts owed by customers. This not only helps understand which clients are slow to pay or have high outstanding balances but also enables companies to identify trends and risks in customer payment behaviour. For SMEs, debt analysis is especially valuable by ensuring timely cash flow reduction in bad debt risk while making the right decisions towards credit extensions to customers.

SMEs can focus on strategies that improve collection processes, minimise write-offs, and keep working capital optimised by harnessing debt analysis. Furthermore, having specific insights into debtor behaviour enables better decision-making in managing credit risk and negotiating payment terms.

1. Debt-to-Equity Ratio (D/E)

Definition: The D/E ratio measures the percentage of a company’s debt compared to its shareholders’ equity. It gives the percentage by which a business is financed by debt as compared to internal funds or equity. The greater the ratio, the higher the financial leverage and, hence, the more dependent the firm is on borrowed funds.

Significance:

- Shows how financially healthy and risky a company is

- High debt compared to owner money = risky

- Low debt compared to owner money = safer

- Lenders check this to know if loans can be paid back

2. Debt-to-Asset Ratio

Definition: Shows how much of a company’s property and assets were bought using borrowed money versus their own money. This tells us how much the company depends on loans to run its business.

Significance: When companies use more of their finances to buy things, they are more risk-averse. When they borrow too much money, they might have trouble if the economy takes a downturn or they run low on cash.

3. Interest Coverage Ratio

Definition: The Interest Coverage Ratio evaluates a firm’s ability to service interest payments based on its EBIT. This is a significant indicator of health and reveals how easily the company covers its debt service costs.

Significance: A ratio of more than 1 means sufficient earnings to cover the interest expenses, thereby meaning financial stability. Any ratios below 1 mean low earnings and, therefore, the risk to a company’s credit is high, hence raising the probability of default. Lenders and investors like a high ratio because it represents strong financial control and low worries over servicing the debt.

4. Debt Service Coverage Ratio (DSCR)

Definition: Shows if a company makes enough money from its regular business to pay back its loans and interest. It helps tell if a business can handle its debt payments from the money it makes.

Significance: When a company’s DSCR is above 1, it means they make enough money to pay their debts, which makes lenders satisfied. When it’s below 1, it’s a warning sign – the company might not be able to pay its debts, which makes lending to them risky.

5. Operating Cash Flow to Debt Ratio

Definition: It determines the percentage of total debt that is payable through the operating cash flow of the company, providing a complete insight into liquidity and the enterprise’s ability to continue financing debt without external help.

Significance: A higher ratio indicates that a company is liquid and can sustainably service its debt using internally generated cash. The lower ratio may indicate that the company may face cash flow problems and hence need to seek external financing or change its debt management strategy.

How Pulse’s Debt Analysis Module Helps SMEs

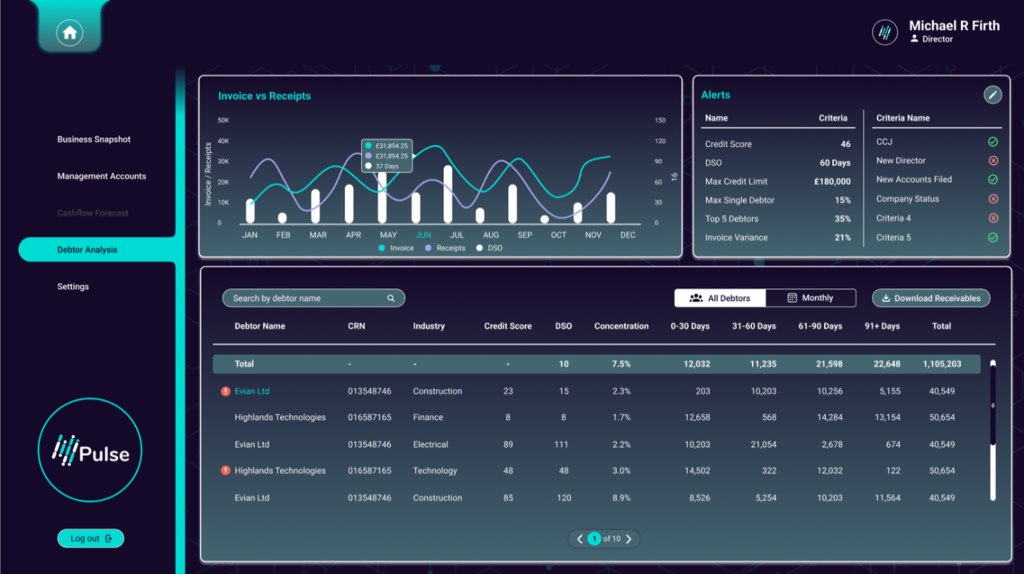

Pulse’s Debt analysis module will be specifically targeted to help SMEs better manage their receivables and understand debtor behaviours with more precision. The module provides the value that can help enhance cash flow management, reduce bad debt risk, and make better decisions around credit.

Below are the key features of Pulse’s Debt analysis module:

- Debtor Profiles: SMEs can view detailed profiles of each debtor, including a history of invoices and payment trends. Pulse allows businesses to visualise data in graphs, comparing outstanding invoices to settled receipts, making it easier to identify late payments or recurring issues.

- Debtor Payment Behaviour: By analysing payment habits, Pulse identifies whether a debtor is high-risk or has a consistent history of paying on time. This insight enables SMEs to make more informed decisions regarding future credit offerings.

- Total Outstanding Amount: Pulse offers an overview of all unpaid invoices or receivables, providing SMEs with a clear view of the amounts they are still waiting to collect from their customers.

- Ageing Report: Shows how long debts have been unpaid. Groups what people owe into time periods (30, 60, and 90 days) to show which payments are most at risk of not being collected.

- Risk Analysis: Learn how looking at who owes you money can help you make smarter choices for your business’s money and growth.

Parting Thoughts

Debt analysis is an important financial tool a business uses to evaluate its overall financial health and manage its liabilities effectively. SMEs especially rely on debt analysis. Assess different kinds of debt-related metrics which convey the amount of debt, servicing efficiencies by a company for that particular debt, and the kind of vulnerability this holds against defaulting. Utilisation of debt analysis enables corporations to establish stronger perceptions of financial obligations towards optimal flow, risk management, and possible future growth.

For SMEs in the UK, this process is even more crucial as they often face challenges in balancing cash flow, servicing debt, and maintaining profitability. Proper insights from debt analysis enable them to identify problems and prevent delayed payments and creditor management difficulties.

To fully leverage the benefits of this module, book a demo today. Learn how Pulse’s debtor analysis can help you make better-informed decisions for improving your financial health and sustainable growth.

Related Blogs